Moves to Expand Overseas Operations

Woori Financial Group signs biz tie-up with BBVA of Spain to broaden its overseas banking presence

Woori Financial Group (WFG) signed a business tie-up with Banco Bilbao Vizcaya Argentaria (BBVA), the second largest bank in Spain, on Oct. 12, the financial group said recently.

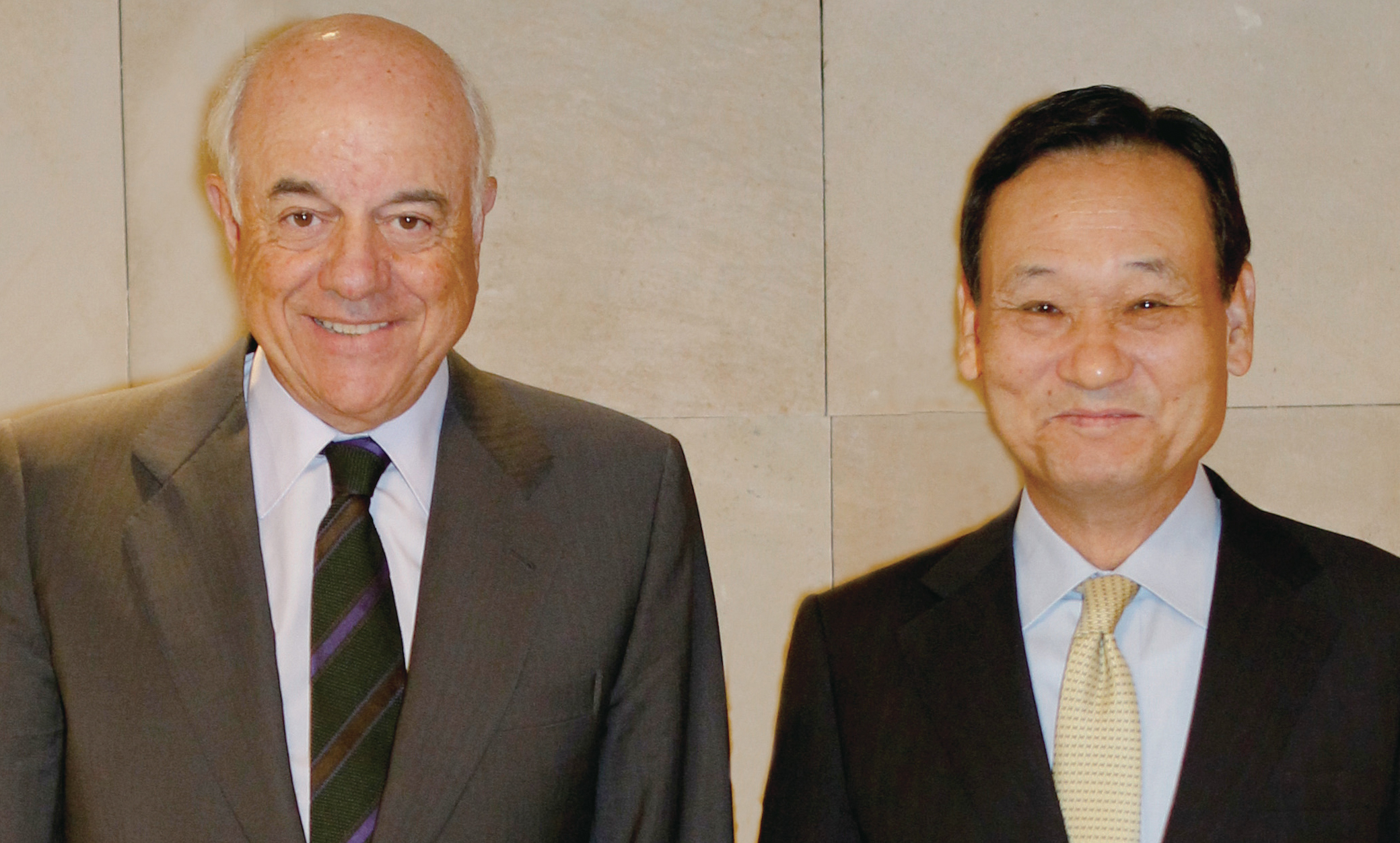

Chairman Lee Pal-seung signed the agreement in Madrid on Oct. 11 with his counterpart Chairman Francisco Gonzales signing for the Spanish bank.

The strategic tie-up involves such areas as the expansion of customers and business territory, the exchange of hedge products and bonds, and cooperation in the sales of financial products in Europe and South America, among others, the group said.

The Spanish bank's total assets amounted to 820 trillion won last year, ranked the 35th largest in the world, according to British financial magazine The Bank. BBVA opened a branch in Seoul last month, the group said.

Officials of the group said the Spanish bank has an extensive financial network in Latin America, the region with a large Spanish cultural heritage, and Woori counts on support from BBVA when it sets up a branch in Brazil next year.

Woori Financial Group said it signed a memorandum of understanding (MOU) for a strategic partnership with Bank of Communications, one of China's five major commercial banks.

This strategic partnership has been promoted not only to spur the global operation of the group with the goal of entering the global top 50 by 2015, but also to pave the way for sustainable growth. This contract includes customer recommendations, the cross selling of products, global partnerships, support for fundraising and sharing information, etc.

In particular, great synergy effects are expected from the operational capacities of WFG subsidiaries and the vast financial network of the Bank of Communications. Woori Bank China, a local subsidiary, also expects to carry forward diverse businesses in the region.

Taking the contract opportunity, both companies plan to expand business categories such as the cross-selling of products and the settlement of China's currency.

The Bank of Communications, uniquely rooted in Shanghai among China's five major banks, has played a leading role in the development of the Chinese financial market for a long time. In 2005, it became the first bank to be simultaneously listed on the Hong Kong and Shanghai exchanges. Total assets were 697 trillion won as of the end of March 2011, keeping it in the world's top 50.

An official of Woori Financial Group said, "We are expecting this contract and partnership to be a solid foundation for consolidating the leadership in financial markets in each country and for enhancing global competitiveness."

In the meantime, Woori Financial Group posted 3.948 trillion won in operating profit in the first half with net income running up to 1.237 trillion won, the group said recently.

Woori Financial Holdings Co. saw its operation being turned around in the second quarter with net profit of 765.3 billion won on operating profit of 1.213 trillion won, thanks largely to the one-time non-banking profit from the sale of Hyundai Construction, giving the company a cash income of 965.3 billion won.

Net interest margin in the second quarter improved a little from the previous quarter at 2.45 percent.

Other factors that helped the company turn around were the reduced loan loss provisions from 3 percent to 2.42 percent in Q2, although the company spent a lot for the health of its financial conditions, amounting to 1.668 trillion won, including the sale or write off of 772 billion won worth of bad debts and 896 billion won of non-performing assets. nw

Woori Financial Holdings Co. saw its operation being turned around in the second quarter with net profit of 765.3 billion won on operating profit of 1.213 trillion won, thanks largely to the one-time non-banking profit from the sale of Hyundai Construction, giving the company a cash income of 965.3 billion won.

Chairman Lee Pal-seung, right, of Woori Financial Group poses with Chairman Francisco Gonzales of BBVA after signing an MOU for cooperation in Madrid, Spain, on Oct. 11.

Photo on courtesy of Woori Financial Group

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799