Korea Among Global Top Six Parts and Materials Suppliers

Registers a quantum 3.7-fold surge over a decade ago

The Korean parts and materials industry has come from strength to strength to rise to the rank of world's sixth biggest parts and materials supplier.

Korea chalked up $229 billion in parts and materials exports last year, representing a 3.7-fold surge over a decade ago, while the trade balance in the sector swelled to a record high of $77.9 billion, 28 times higher than 10 years ago.

As a result, Korea saw its share in the global parts and materials market rising from 10th place in 2001 to sixth place in 2009, trailing Germany, China, the United States, Japan and Hong Kong. Korea surpassed powerhouses such as France and Italy during the 10-year period. The Korean industry saw its global marking share standing at 4.6 percent.

Noteworthy is the fact that Korea has made a strong showing in the value-added parts and materials segments. Liquid crystal displays, which were one of the items with trade deficits, turned around to a $27.3 billion surplus last year, while broadcasting and telecommunications equipment had a $6.7 billion surplus. This was owed to aggressive technology development in vulnerable items such as steel, semiconductor chips and displays and a higher portion of localization.

Lee Seung-woo, director of the Ministry of Knowledge Economy's Components & Materials Division, said, "Parts and materials makers, which were marginalized in the past, have grown dramatically in terms of quality and scale." For instance, the number of companies that posted more than 200 billion won in sales and more than $100 million in exports surged to some 100 in 2004, he said.

However, Korea still faces the dilemma of how to narrow a trade surplus in favor of Japan, even though Korea's dependence on Japan for parts and materials declined from 28.1 percent to 25.2 percent. Due to Korea's higher dependence on Japan for essential parts and materials of Korea's mainstay exporting items such as displays and automobiles, the more finished products that are exported, the higher the trade gap in favor of Japan has been widening.

Recognizing the need for providing continuous support to help the domestic parts and materials industry beat its Japanese counterpart, the Korean government plans to renew for another decade the Special Act on Parts and Materials, which is to expire by the end of this year.

The Korean parts and materials industry's competitiveness is increasingly recognized globally as it grew up to the 90 percent level of advanced countries, according to the Korean Institute for the Advancement of Technology (KIAT). Korea saw its design technology, which was left far behind, improving from 67.7 percent 10 years ago to 91.3 percent in 2010; the technology of developing new products surging from 66.4 percent to 91.6 percent; production technology swelling from 77.8 percent to 94.4 percent; and quality and reliability soaring from 85 percent to 93.1 percent.

The remarkable growth of the domestic parts and materials sector was owed to the government's massive support. nw

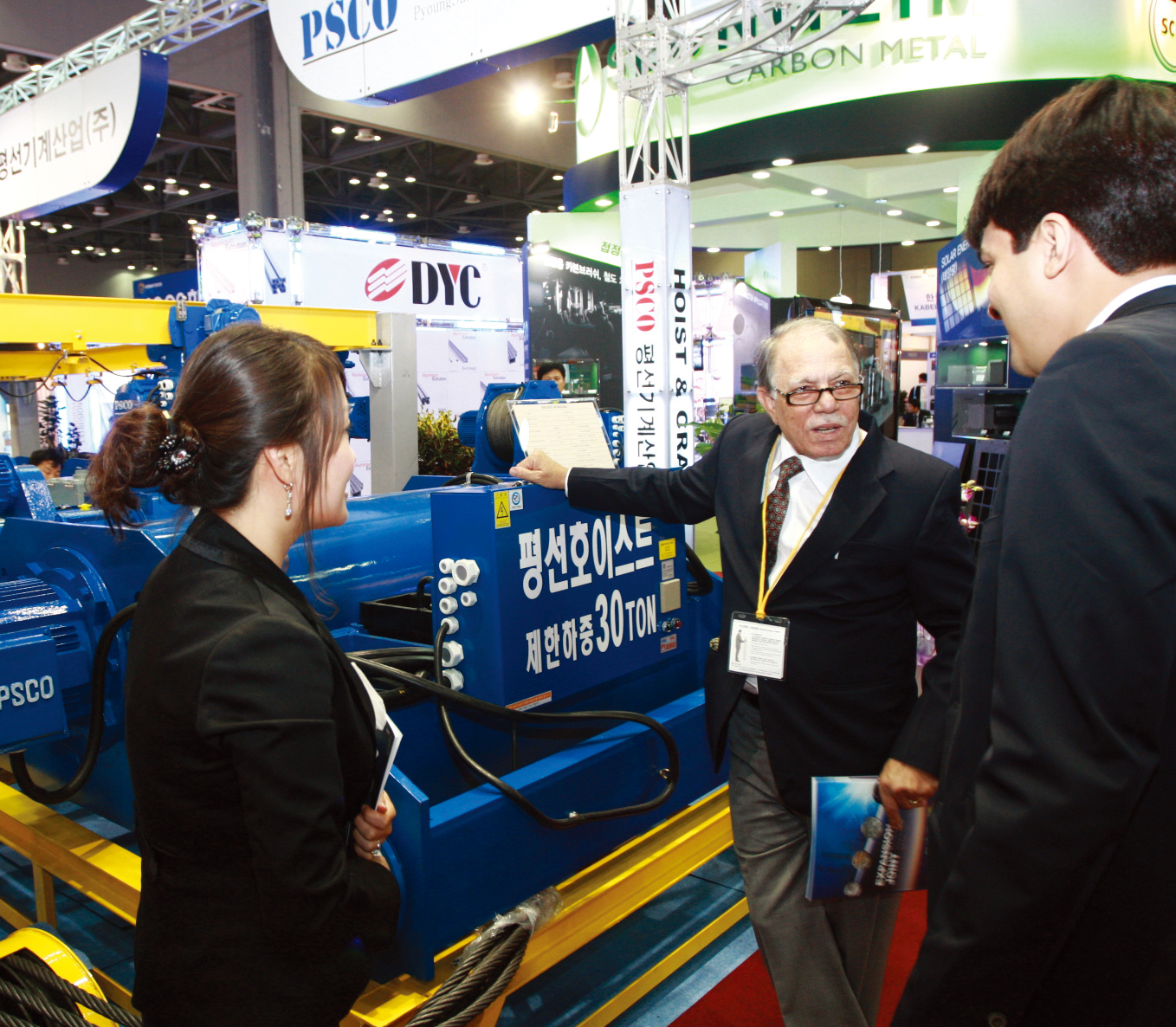

The Korean parts and materials industry has seen a quantum leap during the past decade, but still face a trade imbalance in the sector in favor of Japan. Above views of Korea Machinery Fair 2009.

Photo on Courtesy of MKE

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799