Minister Yoon Takes Mediating Role At G-20 Finance Meeting

Progress made in easing the global imbalance

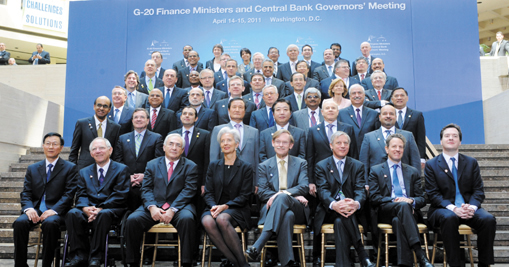

(Photos clockwise) Minster Yoon Jeung-hyun of the Ministry of Strategy and Finance is seen at the G-20 Finance Ministers and Central Bank Governors Meeting on April 14-15 in Washington with Gov. Kim Choong-soo of the Bank of Korea to his right. Minister of Strategy and Finance Yoon Jeung-hyun chats with French Finance Minister Christine Lagarde and IMF Managing Director Dominique Strauss-Kahn at the G-20 Finance Ministers and Central Bank Governors Meeting in Washington, D.C., on April 14-15. A group photo of participants at the G-20 Finance Meeting .

(Photos clockwise) Minster Yoon Jeung-hyun of the Ministry of Strategy and Finance is seen at the G-20 Finance Ministers and Central Bank Governors Meeting on April 14-15 in Washington with Gov. Kim Choong-soo of the Bank of Korea to his right. Minister of Strategy and Finance Yoon Jeung-hyun chats with French Finance Minister Christine Lagarde and IMF Managing Director Dominique Strauss-Kahn at the G-20 Finance Ministers and Central Bank Governors Meeting in Washington, D.C., on April 14-15. A group photo of participants at the G-20 Finance Meeting .

Minister of Strategy and Finance Minister Yoon Jeung-hyun attended the G-20 Finance Ministers and Central Bank Governors Meeting in Washington, D.C., from April 14 to April 15. Yoon also had bilateral talks with his counterparts from major economies including the United States, France, Japan and Saudi Arabia.

Yoon was praised for his mediating role among the global financial leaders in their bids to map out measures to help ease the widening imbalance between wealthy and less developed countries.

Yoon managed to have the nation's stances reflected in the joint statement adopted at the end of the session with regard to ways of easing capital fluctuations along with steps aimed to narrow the gap between the haves and have-nots.

The participants focused their discussions on the global economy and a framework for strong, sustainable and balanced growth and the reform of the international monetary system and financial regulations.

The participants adopted the joint communique, wrapping up of the Washington meeting, which said the Group of 20 finance chiefs may identify six to seven countries that have persistently large trade or capital-flow imbalances.

South Korean officials said, "One of the major expected achievements will be how to apply the yardsticks and agree on who can affect global imbalances most."Lee Jun Kyu, senior adviser to the finance minister, said, "here still remain differences and difficulties, but a sensible outcome is likely."

Seeking to smooth lopsided trade and investment flows, the G-20's finance ministers and central bankers concluded talks in Paris on Feb. 20 by listing the data they will monitor to see whether imbalances are forming. The criteria are public debt and fiscal deficits, private debt and savings rates, trade balances and net investment-income flows and transfers.

Sohn Byung-doo, director general of the G-20 bureau at the ministry, said the G-20 won's reveal to the public which major countries are responsible for global imbalances. Identifying the names internally will help the G-20 craft economic policy guidelines for each country to be agreed by November when the leaders meet in Cannes, France, he said.

Currency Issue

The issue of currency swaps among central banks, with the International Monetary Fund as a mediator, may be raised as a way to enhance the global financial safety net, Lee and Sohn said. The idea, dropped last year due to strong opposition from some advanced economies, reemerged last month at a Nanjing seminar of G-20 finance chiefs, they said.

Emerging countries may want to shift the focus of the talks on capital control away from whether the measures are appropriate to who has caused the problem and why, the two said.

The IMF announced last week a staff proposal to endorse capital controls in limited circumstances, which aroused opposition from Brazil and other nations seeking greater freedom, to stem inflows of money. The proposal backs the use of capital controls as a last resort after nations strengthen banking systems and adopt measures such as building up reserves, tightening fiscal policies and lowering interest rates.

"Minister Yoon will try hard in Washington to bridge the gap between advanced and emerging countries on several sensitive issues so that the G-20 can continue to work as an effective premier forum,"Lee said. In the joint communique, the G-20 Finance Ministers and Central Bank Governors said they addressed the economic challenges at hand and made progress on their previous commitments.

"We reaffirmed that our overriding objective is to improve the living standards of all our citizens through strong economic and jobs growth. We expressed our solidarity with the Japanese people after the tragic events, our readiness to provide any needed cooperation, and our confidence in the resilience of the Japanese economy and financial sector,"they said. Regarding the global economic issue, they said the global recovery is broadening and becoming more self-sustained, with increasingly robust private demand growth. But downside risks still remain. "We agreed to remain vigilant and to take the actions required to strengthen the recovery and reduce risks. Events in some Middle Eastern and North African countries and in Japan have increased economic uncertainty and tensions in energy prices. We noted there is adequate spare capacity to meet global energy demand." In order to enhance the mutual assessment process to promote external sustainability, they agreed on a set of indicative guidelines that complete the first step of their work to address persistently large imbalances. "We now launch the second step of this process with an in-depth assessment of the nature of these imbalances and the root causes of impediments to adjustment. Based on this analysis, the IMF assessment on progress toward external sustainability, as well as the other aspects of our mutual assessment process, we will ascertain for our next meeting the corrective and preventive measures that will form the 2011 action plan to ensure strong, sustainable and balanced growth, to be discussed by leaders at the Cannes Summit," they said. "To strengthen the international monetary system, we agreed to focus our work, in the short term, on assessing developments in global liquidity, a country specific analysis regarding drivers of reserve accumulation, a strengthened coordination to avoid disorderly movements and persistent exchange rate misalignments, a criteria-based path to broaden the composition of the SDR, an improved toolkit to strengthen the global financial safety nets, enhanced cooperation between the IMF and regional financial arrangements, the development of local capital markets and domestic currency borrowing and coherent conclusions for the management of capital flows drawing on country's experiences. We also agreed on the need to further strengthen the effectiveness and coherence of bilateral and multilateral IMF surveillance, particularly on financial sector coverage, fiscal, monetary and exchange rate policies,"the communique said. nw

-photo on courtesy of MINISTER OF STRATEGY AND FRINANCE

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799