Hyundai Motor Takes over Hyundai E&C

Consortium led by Hyundai Automotive Group finalizes deal with creditors of the builder

The consortium led by Hyundai Automotive Group has finalized the price for its takeover of Hyundai Engineering and Construction Co., recently with the creditors of the construction company agreeing with the group¡¯s request to reconsider its bid price in light of the builder¡¯s debt figures, which increased from the data shown in the official financial statement

The consortium led by Hyundai Automotive Group has finalized the price for its takeover of Hyundai Engineering and Construction Co., recently with the creditors of the construction company agreeing with the group¡¯s request to reconsider its bid price in light of the builder¡¯s debt figures, which increased from the data shown in the official financial statement

During the final assessment of the construction company¡¯s assets, the automotive group officials found that the builder had more debts than recorded in its financial statement totaling around 800 billion won. But the new debts were turned out to be non-existent and occurred due to miscommunication between creditors and the Hyundai consortium.

The final takeover price was settled at 4.96 trillion won, 139.9 billion won less than the bid price of 5.1 trillion won. Hyundai Group was the priority bidder, but the creditors had to disqualify its bid due to its failure to correctly explain its funding resources and named the automotive group¡¯s consortium to replace Hyundai Group as the final bidder.

Korea Exchange Bank, the leader of the creditors of the construction company said the creditors was able to iron out the increased debts and agreed on the final bid price. The official agreement was expected to be signed following the construction company¡¯s shareholders¡¯ meeting early in March.

The creditors and the consortium had an intensive negotiation to settle on the final price as the MOU spelled out that the final take over price can be readjusted within the three percentage range of the bid price. Hyundai Motor officials engaged in the final negotiations on the bid price argued that at least 300 billion won had to be cut from its bid price due to the construction company¡¯s increased debts. But later it turned out to be the result of a miscommunication, not a real increase in debts, creditors said.

The Hyundai consortium formally asked for readjustment of its bid price within the legally allowed limits and succeeded in getting it without not much argument during the final talks. Upon signing of an official agreement, the Hyundai consortium is obliged to pay 10 percent of the price and three months later the rest of the price to formally conclude the takeover. But the takeover party is likely to pay up the money sometime in April to finalize the takeover of the leading builder in Korea and the mother company of Hyundai Group founded and led by the late chairman Chung Ju-yung.

As diversification of the construction industry makes the competition among contractors increasingly fierce, Hyundai E&C is gearing up to enter a new market based on new branches in China. Hyundai E&C CEO Kim Joong-kyum visited Shanghai and Beijing for two days from January 19 to forge close relationship with China-based major builders and equipment suppliers. To examine the potential of establishment of Hyundai E&C¡¯s Chinese office, CEO Kim made a survey of potential sites where new branches are scheduled to open and analyzed the level of cooperation and procurement services in two major cities.

Chinese branches expected to open this year will seek business cooperation with Chinese development companies and EPC contractors specialized in the development of oil, gas and renewable energies and in high technology-intensive civil works, in an aim to join forces to execute projects in Africa, CIS and Central and South America regions. The builder has been engaged in such construction sectors as plant construction, power plant construction, civil works, building works and nuclear power plant construction.

We have built the majority of Korea¡¯s nuclear power plants, including the Kori nuclear power plant¡¯s Units 1~4, the Wolseong nuclear power plant¡¯s Units 1~2, the Yeonggwang nuclear power plant¡¯s Units 1~6, and the Korean Peninsula Energy Development Organization¡¯s (KEDO) nuclear power plant¡¯s Units 1~2.

Total independence in nuclear power plant construction technologies was achieved with the Yeonggwang nuclear power plant¡¯s Units 3 and 4. By successfully executing the replacement of steam generators for the Kori nuclear power plant¡¯s Unit 1, we have played a leading role in improving the performance of nuclear power plants. We are currently building Units 1 and 2 of the Shinkori nuclear power plant, which are 1,000 MW-level export models, and Units 3 and 4, which are Korea¡¯s first 1,400 MW-level facilities. By doing so, we are taking the lead in establishing the nuclear power industry as the nation¡¯s new growth engine.

In addition, Hyundai E&C demonstrated the limitless potential of overseas exports for the Korean nuclear power plant construction industry by winning a contract to build nuclear power plants in the UAE at the end of 2009.

One of our highest priorities is to make Korea a top player in the international nuclear power plant market, which is expected to place orders for more than 400 units going forward. nw

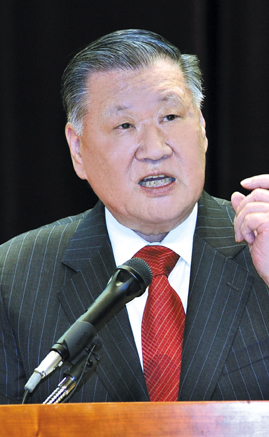

Hyundai Automotive Group Chairman Chung Mong-koo. His group has acquired Hyundai E&C, which was once the flagship company of the Hyundai Business Group, owned by his father Chung Ju-yung.

Photo by courtesy of Hyundai Automotive Group

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799