GS Caltex¡¯s 3rd Heavy Oil Upgrade Facility Put into Commercial Operation

The refinery benefits from upgraded refining facilities coupled with a rise in crack spread

GS Caltex has put into commercial operation the vacuum residue hydrocracker (VRHC) with a daily capacity of 60,000 barrels, the refinery¡¯s third such heavy oil upgrade facility, making it the nation¡¯s biggest conversion facility. The VRHC facility is the nation¡¯s first and the world¡¯s seventh facility of such advanced technology.

¡°Despite the Chuseok holiday last month, the crew were busy preparing for the operation of the VRHC facility, and the plant is now full of humming with a rise in crack spread,¡± a GS Caltex official said.

Korea¡¯s second largest refinery poured a massive 2.6 trillion won into undertaking the third heavy oil upgrade project on a lot of 615,000 square meters. The project, which lasted 21 months with the mobilization of an aggregate crew of 4.5 million, was the biggest one in the company¡¯s history.

The VRHC facility underwent a trial test before full-fledged operations. The trial operation of such utilities as water, electricity and steam were finished as of the end of June, and GS Caltex conducted a test run of such facilities as VRHC, hydrogen production, storage and delivery equipment in late June prior to commercial operation.

The heavy oil conversion facilities use Bunker-C oil as the raw material to produce such value-added products as gasoline and kerosene. GS Caltex¡¯s VRHC facility is an advanced heavy oil upgrade technology using extra heavy oil.

The latest VRHC facility now raises GS Caltex¡¯s daily heavy oil upgrade capacity from the current 155,000 barrels to 215,000 barrels to become the nation¡¯s top heavy-oil upgrade refinery, surpassing SK Energy¡¯s daily capacity of 172,000 barrels.

It allows GS Caltex to raise the portion of such cheaper crude oils as heavy fuel oil, thus lowering unit production costs. It also likely brings about an additional profit of 600 billion won by converting cheap extra-heavy oil products into more environmentally friendly ones.

GS Caltex has prioritized environmental friendliness and safety during the execution of the latest heavy oil upgrade project. The company installed pipelines and facilities above ground instead of burying them to prevent the contamination of the soil and built waste treatment and air pollution prevention facilities to lower their emissions of pollutants below permissible levels.

In a related development, Hyundai Oilbank, which has been acquired by Hyundai Heavy Industries Co., is scrambling to upgrade its refining facilities to transform heavy oil products into value-added ones. GS Caltex has just joined S-Oil, which completed its plan to upgrade refining facilities in 2002. Attention is paid to the upgrading of refining facilities and a rise in the crack spread.

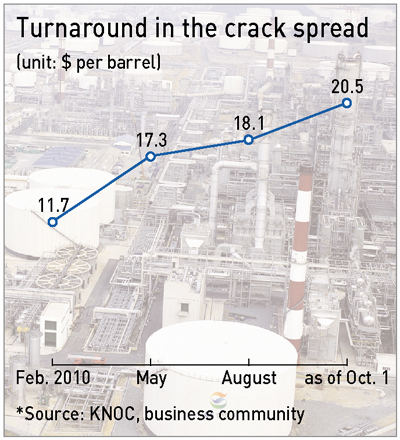

According to the Korea National Oil Corp. and refineries, crack spread, which dropped below $10 per barrel, surged to $20.50 as of Oct. 1.

Upgraded refining facilities to transform such heavy oil products as Bunker C-oil into light oil products are referred to as above ground oil wells, since they bring about higher profits, business sources said.

Heavy oil prices are showing signs of decline, and light oil products have made a strong showing of late, bringing higher profit margins. The recent drop in heavy oil prices is due to a surge in crude distillation units (CDUs) in China, Japan, Korea and Southeast Asian countries, which is causing a surge in the supply of Bunker C-oil products, which normally account for a 40-percent share of the resulting products of refining crude oil. In the meantime, a demand for light oil products is rising due to the recovery of the global economy.

Business sources said, ¡°As crack spread is showing signs of a rise so far this year, refineries will likely see their profitability turn for the better.¡± There is a forecast of few newly-upgraded refining facilities in the Asian region by the end of this year, which could be a boon to Korean refineries, they said.

China is forecast to have newly upgraded refining facilities with an annual capacity of 110,000 barrels while India is predicted to have such new facilities with an annual capacity of 167,000 barrels.

A rise in crack spread could be good or bad news for Korean refineries, according to business sources. In particular, SK Energy refrained from investing in upgrading its refining facilities since 2007 when it acquired Incheon Refinery. The nation¡¯s biggest refinery has the nation¡¯s lowest upgrading rate of around 10 percent. nw

GS Caltex has put into commercial operation a vacuum residue hydrocracker, the company¡¯s third such heavy oil upgrade facility.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799