With Sense of Duty and Pride

Woori Financial Group to continue to make efforts to invigorate economy by supplying funds and financial services as top financial group

Established as Korea¡¯s first financial holding company in April 2004, Woori Financial Group has continued to grow as a world-class leading financial group with a balanced business portfolio including banking, securities, insurance and consumer finance services. Woori Financial Group could make remarkable achievements thanks to ongoing supports and encouragement of its customers and shareholders. To reward these, the group is doing its best efforts with a mission of being a leader of financial power Korea.

Established as Korea¡¯s first financial holding company in April 2004, Woori Financial Group has continued to grow as a world-class leading financial group with a balanced business portfolio including banking, securities, insurance and consumer finance services. Woori Financial Group could make remarkable achievements thanks to ongoing supports and encouragement of its customers and shareholders. To reward these, the group is doing its best efforts with a mission of being a leader of financial power Korea.

The group is also committed to playing a key role in invigorating the economy with a sense of duty and pride as a favorite financial service provider of the nation. Above all, the group will continue to increase its shareholder value through efficiently managing financial risks and focusing on profitability. In addition, it will spare no efforts to emerge as a respectful financial service provider by fulfilling its social responsibilities.

Woori Financial Group said recently its first half profit amounted to 532.4 billion won, although it incurred a loss of 40.6 billion won in the second quarter.

The group said Woori Bank¡¯s loan loss provision rose 43.9 percent in Q2 YoY, but its net income rose 38.2 percent YoY to 147 billion won. The bank expanded its loan loss provision in a preemptive manner before the intensive corporate restructuring, bringing the total loan loss provision to 1.16 trillion won in Q2, up 97.2 percent YoY, the financial group said.

The financial group¡¯s total assets in the first half rose 5.9 trillion won to 331.3 trillion won. The major financial indicators include ROE at 7.7 percent, ROA at 0.4 percent, the BIS rate at 12.2 percent and the ratio of its own capital at 8.5 percent, an improvement YoY, while its banking affiliates¡¯ BIS and own capital ratio registered 14.4 percent and 10.7 percent respectively.

To look at the group¡¯s sector-based financial indicators, the non-performing asset ratio improved by 0.06 percent at 0.82 percent in the first half, while those for SME borrowers improved to 1.16 percent, down 0.29 percent YoY.

In the area of income, interest revenues in the first half amounted to 3.22 trillion won, up 15.5 percent YoY, with net interest margin (NIM) climbing to 2.36 percent, up 0.49 percent YoY.

The average NIM was 2.3 percent in Q2, 0.12 percent lower than the preceding quarter, due to the fall in the CD rate during the quarter, but Q2 income revenue came to 1.61 trillion won, up 0.6 percent from the preceding quarter, contributing to the stability in the group¡¯s revenue as the main part of the group¡¯s income. Fee income came to 434 billion won, up 2.6 percent over the preceding quarter. Woori officials said second half income for the group is estimated to increase as the loss provision is expected to fall and shares in Hynix and Daewoo International are expected to be sold successfully by the end of the year.

Woori Bank, the major affiliate of the group posted 3.7 trillion won in operating income in H1 and net income of 483 billion won in Q2. The operating income rose 691.1 billion won while net income rose 144.2 billion won due to the increase in the loss provision.

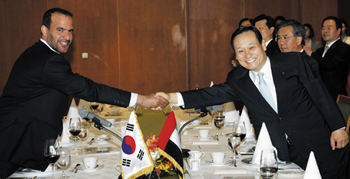

Woori Financial Group announced recently that Nasser Alsowaidi, chairman of the Abu Dhabi Bank and the Minister of Economy Development of Abu Dhabi along with CEOs of major UAE-based companies visited Woori Financial Group to talk over financial cooperation with its chairman Lee Pal-seong and CEOs of Woori subsidiaries.

Chairman¡¯s Lee and Nasser entered into an MOU contract for organic cooperation in the areas of corporate financing, joint ventures and financial consultation at the ¡°Korea-Abu Dhabi Investment Forum¡± held in Abu Dhabi in March 2010.

Abu Dhabi Bank, with total assets of 52 trillion won, is one of Abu Dhabi¡¯s mega banks and provides comprehensive financial services including corporate financing, retail banking, Islamic financing, leasing and private banking.

The bank¡¯s 70.5 percent shares are owned by Abu Dhabi Investment Council, an affiliated investment institute of Abu Dhabi.

An official of Woori Financial Group said, ¡°Since the awarding of nuclear project orders by Korea at the end of last year, economic interchanges within Korea and the United Arab Emirates are expected to be activated. With this in mind, the MOU contract and their return visits will help them further understand Woori Financial Group. We will play a key role in expanding financial cooperation between the two countries in the future.¡± nw

Chairman Lee Pal-seong of Woori Financial Group.

Chairman Lee Pal-seong of Woori Financial Group shakes hands with Chairman Nasser Alsowaidi of Abu Dhabi Bank after signing an MOU for financial cooperation at the Korea-Abu Dhabi Investment Forum held in Abu Dhabi in March, 2010.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799