Samsung Electronics Reports Record Quarterly Operating Profit

Warns of unfavorable business environment in the second half

Samsung Electronics posted a record-high performance for the second quarter thanks to strong demand in semiconductors and liquid crystal displays. The Korean electronics giant recorded 37.9 trillion won ($32.1 billion) in sales for the three months ended June 30, up 17 percent from the same period last year. The company raked in 5.01 trillion won in operating profit in the second quarter for an 88 percent year-on-year increase, marking the first time that the company¡¯s operating profit has exceeded 5 trillion won. Samsung saw net profit also hitting a record 4.28 trillion won, up 83 percent year-on-year.

Samsung Electronics posted a record-high performance for the second quarter thanks to strong demand in semiconductors and liquid crystal displays. The Korean electronics giant recorded 37.9 trillion won ($32.1 billion) in sales for the three months ended June 30, up 17 percent from the same period last year. The company raked in 5.01 trillion won in operating profit in the second quarter for an 88 percent year-on-year increase, marking the first time that the company¡¯s operating profit has exceeded 5 trillion won. Samsung saw net profit also hitting a record 4.28 trillion won, up 83 percent year-on-year.

But despite the record earnings, Samsung Electronics appears to not be celebrating because of gloomy prospects for business conditions in the second half of the year. Such uncertainties as the financial crisis in Europe, foreign exchange fluctuations and fierce competition continue to loom. In particular, the government has called for big companies to focus on social responsibility. Korea Communications Commission Chairman Choi See-jung said even though Samsung Electronics posted a record high quarterly operating profit, low-income earners feel a relatively greater sense of deprivation.

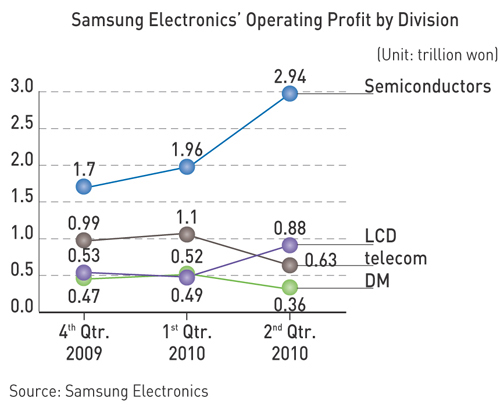

Samsung Electronics recorded 2.94 trillion won in operating profit in the semiconductor sector and 3.82 trillion won in the parts sector, including LCDs, which accounts for 76 percent of the total operating profit for the second quarter.

Operating profit in the semiconductor sector jumped 765 percent over the same period of last year, while sales in the sector surged 55 percent to 9.53 trillion won.

The LCD sector saw sales rising 31 percent year-on-year to 7.76 trillion won while operating profit soared 252 percent year-on-year to 880 billion won. The achievement was owed to a second straight quarter of strong demand in the semiconductor, LCD and other parts sectors, stabilized prices and other favorable market conditions, improved unit price competitiveness through prior investments and improved profitability with the expansion of value-added items.

Samsung Electronics saw the mobile phone and TV sectors rise in terms of global market shares, but fall in profitability due to a more fierce competition among firms and the falling value of the euro. The mobile phone sector saw balanced growth over all areas to post 8.78 billion won in sales and 630 billion won in operating profit. In the mobile phone sector, Samsung Electronics plans to push for double-digit profit growth by expanding its line of smartphones and increasing sales, as companies are predicted to step up the release of their strategic smartphones. Emerging markets such as China are seeing an increase in demand for 3G phones and are forecast to take the lead in the whole of the global markets.

In particular, Samsung Electronics plans to sell the ¡°Galaxy S,¡± emerging as a representative Android-OS model, through 125 marketers in 90 countries by year-end. The Korean company aims at selling an aggregate of more than 10 million units of two ¡°Wave¡± models running its own OS by expanding the number of marketers to 178 in 98 countries by the end of this year.

In the digital media sector, electronics makers are expected to compete fiercely in the LED 3D TV market, as the demand for TVs is forecast to grow starting in September and the portion of LED TVs out of the LCD TV sector is likely to widen to 30 percent.

EXPANDED INVESTMENTS ¡ª Despite some uncertainties in the global economy and IT demand, Samsung Electronics announced a plan to invest a record high of 26 trillion won in late May. It has executed 9.2 trillion won or 51 percent of 18.2 trillion won set aside for facility investments. The move is part of the company¡¯s strategy to seize more business opportunities and build infrastructure for sustainable growth by strategically expanding investment. A senior investor relations official at Samsung Electronics said the company is expected to build a solid unit price and technology competitiveness in the next five to 10 years by making massive investments in such mainstay business areas as semiconductors and the LCD sectors in order to have an upper hand in terms of technology and market shares. nw

Samsung Electronics President & CEO Choi Ji-sung

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799