ROK Expected to Record 4.6% GDP Growth in 2010

Exit measures will test the Korean economy

Despite lingering concerns over the possible deterioration in the economic situation, Korea has been faring well in 2009, outmaneuvering its peers among Organization of Economic Cooperation and Development (OECD) member nations. The year 2010 will likely be a litmus test for Korea in its bid to leap again to rank among the advanced industrial powers in the real sense of the word.

Despite lingering concerns over the possible deterioration in the economic situation, Korea has been faring well in 2009, outmaneuvering its peers among Organization of Economic Cooperation and Development (OECD) member nations. The year 2010 will likely be a litmus test for Korea in its bid to leap again to rank among the advanced industrial powers in the real sense of the word.

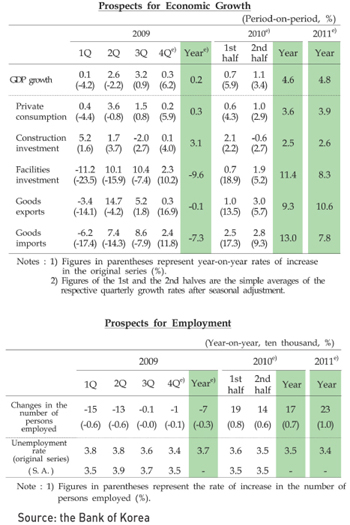

The Bank of Korea (BOK) expects the country¡¯s gross domestic product (GDP) to grow by 4.6 percent next year, which is slightly lower than the government¡¯s estimate of 5 percent growth.

The number of jobs will grow by 170,000, with the unemployment rate standing at 3.5 percent, the bank predicted.

It projected a 0.2 percent growth for this year, which would be the lowest level since 1998, when it contracted by 6.9 percent.

The central bank explained that a decrease in the demand for cars would hinder growth in the first half of next year, while the second half would be better.

¡°The growth rate could be higher than our outlook if the private sector recovers as a growth engine and credit at U.S. commercial banks normalizes quickly,¡± a representative for the central bank said.

He added that the 4.6 percent economic growth would be the biggest among the OECD member countries. The 4.6-percent growth estimate, however, is lower than the Ministry of Strategy and Finance¡¯s estimate of 5 percent growth announced Thursday. It is also slightly lower than the consensus among the country¡¯s major economic research institutes of 4.73 percent.

However, it is higher than the International Monetary Fund¡¯s (IMF) estimate of 4.5 percent, and the OECD¡¯s 4.4 percent prediction.

The country maintained growth of over 5 percent in 2006 and 2007, but it slowed to 2.2 percent in 2008 due to the global financial crisis.

The job market is also expected to improve. The central bank expected the number of jobs to increase by 170,000 next year, compared to this year, when 70,000 jobs were lost. The unemployment rate, hence, would fall to 3.5 percent from the 3.7 percent of this year.

This is slightly more pessimistic than the prediction by the Ministry of Strategy and Finance, which expects 200,000 positions to be created next year. ¡°It will be difficult for the job market to reach pre-crisis levels as it would involve solving structural problems,¡± the central bank said.

It expects the country¡¯s current account to mark around a $17 billion surplus next year, falling from this year¡¯s $43 billion surplus. This is higher than the government¡¯s estimate of a $15 billion surplus. Exports will grow by 9.3 percent, but rising international oil prices, which the central bank estimates to average $83 per barrel next year, could pull down the current account surplus, it said.

Exit measures to test Korean economy

The Korean economy has been in the global limelight, as it has recovered from the global economic turmoil at the fastest pace on the back of the government¡¯s expansionary policies.

However, analysts said that the resilience of Asia¡¯s fourth-largest economy would be truly tested early next year when the country is expected to wrap up most of its exit measures in line with a possible interest rate hike. Policymakers and central bankers have pledged to continue expansionary fiscal and monetary policies until they see a sustainable recovery, citing slowing growth momentum and growing external uncertainties, such as Dubai¡¯s debt problem.

But in reality, they have already begun withdrawing a range of emergency steps introduced to cope with the global economic downturn. The BOK has retrieved most of the emergency funds extended to banks and corporations, while the government is set to scrap many tax deduction schemes for businesses and households and withdraw other financial support next year.

Given the faster-than-expected economic growth in the previous two quarters and the looming side effects of the loose monetary policies, the BOK¡¯s rate hike campaign, which is at the center of the nation¡¯s ¡°exit plan,¡± may start in the first quarter of 2010.

The Ministry of Strategy and Finance and the central bank have said they would implement an exit strategy in the second half of 2010 at the earliest, vowing to facilitate the ongoing rebound through aggressive fiscal spending, low borrowing costs and other pump-priming steps.

However, the BOK has collected all of its dollar-denominated loans, amounting to $19.5 billion, which were extended to banks and other financial services firms at the height of the worldwide credit crunch. It has also retrieved 18.5 trillion won extended to the financial sector in bond repurchase agreements.

In a currency swap arrangement with the United States in October last year, the bank borrowed $30 billion from the world¡¯s largest economy and provided as much as $16.4 billion to domestic lenders. Of the $16.4 billion, $13.3 billion has been withdrawn, with only $3.1 billion remaining in the hands of financial firms.

A ¡°fast track program¡± under which cash-strapped small firms undergo restructuring in exchange for fresh loans will be wound up in June 2010. Local banks have so far provided a total of 22.7 trillion won through this program. Government guarantees of the debts of small businesses and other financial aids for companies are expected to come to a halt within the first half of next year.

A senior government official said soft loans and other state-supplied liquidity had been retrieved during the second half of the year, adding the withdrawal process would be completed in the first half of 2010. ¡°With temporary measures introduced to overcome the crisis coming to an end, the Korean economy will function in pre-crisis mode from the latter half of next year.¡±

Despite lingering global uncertainty and other external negatives, the central bank is widely expected to raise its key rate in the first quarter of 2010. On Dec. 10, BOK Governor Lee Seong-tae said the current level of the key interest rate was considered too low given that next year¡¯s economic growth is forecast to reach around 4 to 5 percent. ¡°I believe we have to gradually move away from supportive policies.¡±

The BOK has frozen its policy rate since March, putting the brakes on a monetary easing cycle that trimmed the rate by 3.25 percentage points since October last year.

A speedier exit from emergency steps reflects growing optimism in Korea¡¯s economy among policymakers. nw

South Korean President Lee Myung-bak gives a key-note speech at the 15th Climate Change Conference in Copenhagen on Dec. 19.

President Lee Myung-bak presides over a government-civilian session on the status of the national economy and the government¡¯s economic tasks in which representatives from government, industry, academia and other walks of life discussed economic policies the government will implement in 2010 at Cheong Wa Dae on Dec. 10.

Photo by courtesy of the MCST

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799