SFG¡¯s Surprise Q3 Performance

Shinhan Financial Holding sees its banking sector led by Shinhan Bank¡¯s outstanding Q3 results

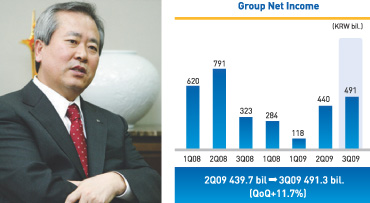

Shinhan Financial Holding Co. recorded a surprising Q3 result with an operating profit of 763.3 billion won, up 47.5 percent YoY, and a net profit of 491.3 billion won, up 52 percent YoY, the company announced recently.

Shinhan Financial Holding Co. recorded a surprising Q3 result with an operating profit of 763.3 billion won, up 47.5 percent YoY, and a net profit of 491.3 billion won, up 52 percent YoY, the company announced recently.

Sales in the quarter were down 33.4 percent YoY at 10.597 trillion won, although it far exceeded the estimates by securities analysts, according to reports. They estimated that the company¡¯s operating profit would reach 562.4 billion won and net profit would hit 386.5 billion won on average.

The results far exceeded even the most optimistic figures projected by Hana Securities of an operating profit of 638.7 billion won and net profit of 485.8 billion won, the company said.

The enviable record has been attributed to a wide net interest margin (NIM) for Shinhan Bank and Shinhan Card, two of the holding company¡¯s major affiliates, as well as reductions in the loss provisions in Q3 and very good performance results by other affiliates. Many large companies completed their restructuring as the economy began to improve further during the quarter and pre-emptive measures to preclude credit risks led to a reduced number of defaults, the company said. The situation contributed to the cutting of loss provisions by 70.4 percent, as the scale of default shrank, and the reductions in one-time loss provisions due to an elimination of various risk factors, thanks to improved economic conditions.

At the end of September, Shinhan Bank¡¯s default ratio stood at 0.79 percent, household loan default ratio at 0.35 percent and that of SME borrowers at 1.44 percent, showing a huge improvement from the preceding quarter, a trend that is likely to continue in Q4.

Shinhan Bank¡¯s NIM stood at 1.74 percent, rising 0.28 percentage points from the preceding quarter, raising the bank¡¯s interest income by 121.8 billion won, as its performing assets totaled 174 trillion won during Q3. The bank earned an after tax income of 86 billion won, which shows the bank¡¯s actual net profit jumped to 288.8 billion won during Q3 from 202 billion won in the previous quarter.

In particular, the NIM for the credit card firm rose 11 basis points from Q2 to Q3, helping the group¡¯s profit vis-a-vis a 10.1 percent increase from the previous quarter. Besides NIM, the loss provision was reduced due to the soundness of assets in Q3, also helping greatly to increase net profit for the bank. The ratio of non-performing assets fell to 1.61 percent in Q3 from 1.77 percent in Q2, which was due to improved performance results for the corporate sector, reducing defaults on its loans thanks to the economic recovery and the completion of corporate restructuring.

The company said they expected NIM would continue to be favorable in Q4 on about the same level as it had been in Q3 when it recovered to the 3 percent level from its low level in Q2.

The non-financial affiliates also compiled very good results in the quarter, including life insurance, credit card and securities firms with their contribution to the group¡¯s total income rising to 61.7 percent in Q3 from 50 percent on average in recent years.

The group¡¯s non-banking sector also performed well in Q3, leading to the group¡¯s outstanding position in the financial industrial sector in the country. The sector recorded 352.2 billion won in net profit in Q3, while the banking sector (Shinhan Bank and Jeju Bank) ran up a net profit of 292.9 billion won, up 42.5 percent from the preceding quarter. The non-banking sector¡¯s exemplary performance has been of great help in making up for the under performance of such affiliates as Shinhan Card and Shinhan Insurance and the banking affiliates, playing a large role in maintaining the group¡¯s sound performance.

However, the banking sector has been rapidly recovering from stagnant performances with the improvement in the economy, balancing the group¡¯s profit levels. Non-banking affiliates put in a good performance in Q3 with net profit up to 352.2 billion won, about the same as those in the preceding quarter, covering for the banking sector¡¯s dismal results so far for the year.

Officials of Shinhan Financial Holding said they will strengthen the balanced development of both the banking and non-banking sectors so that a 50-50 ratio of their contribution to the group¡¯s growth would continue. nw

President Shin Sang-hoon of Shinhan Financial Group.

This chart shows Shinhan Financial Group¡¯s vastly improved performance in the third quarter.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799