Upbeat on Plant Project Orders

Higher oil prices and resurgent world economy project optimistic figures for securing overseas plant project orders

Korean construction firms won overseas plant construction project orders worth $16 billion during the third quarter, the largest quarterly figures, surpassing $15.1 billion for the same period last year, the Korea Plant Industrial Association and the Ministry of Knowledge Economy (MKE) announced recently. The plant construction projects overseas secured by Korean builders amounted to only $6.4 billion in 2003, but the figure expanded rapidly in the past five years to record $46.2 billion in 2008, emerging as a key industrial sector joining such elite industrial sectors as automobile, shipbuilding and semiconductor, said the MKE.

Korean construction firms won overseas plant construction project orders worth $16 billion during the third quarter, the largest quarterly figures, surpassing $15.1 billion for the same period last year, the Korea Plant Industrial Association and the Ministry of Knowledge Economy (MKE) announced recently. The plant construction projects overseas secured by Korean builders amounted to only $6.4 billion in 2003, but the figure expanded rapidly in the past five years to record $46.2 billion in 2008, emerging as a key industrial sector joining such elite industrial sectors as automobile, shipbuilding and semiconductor, said the MKE.

Overseas plant construction projects remained sluggish until Q3, amounting to only $7.4 billion, down 67 percent YoY, but new orders recovered sharply in Q3, owing partly to the recovery of oil prices led by a steady resurgence of the world economy. Plant construction project orders in the Middle East and Africa, in particular, have seen a rapid expansion. The breakdown of the Q3 plant project orders overseas shows Samsung Engineering won a big order amounting to $2.6 billion for the construction of the Skida Oil Refinery in Algeria, followed by the Jubail Oil Refinery Project in Jubail, Saudi Arabia, worth $2.4 billion won jointly by Daelim, SK Construction and Samsung ENG. Next, were the IGD Project, worth $3.9 billion, clinched jointly by Hyundai Heavy, Hyundai Construction and GS Construction, and the Rabic Heavy Oil Power Plant project in Saudi Arabia, worth $2.5 billion, won by Korea Electric Power Corp, along with other major projects. The member countries of the Gulf Cooperation Council (GCC) ordered most of the oil and gas plant construction projects in the Middle East totaling $11.9 billion, up 35 percent YoY, showing the region¡¯s continued strength to build such large projects as oil refining and exploration facilities. The GCC member countries include Saudi Arabia, Kuwait, the UAE, Bahrain, Oman and Qatar. The orders break down to $5.8 billion in Saudi Arabia, $3.9 billion in the UAE, $1.4 billion in Kuwait and $700 million in Iran.

Africa and Asia also began to place large plant construction orders lately with their industrial infrastructure construction plans coming to fruition lately. Reductions in the number of orders for drill ships, EPSOs and marine plant construction projects have been caused by delays in the issuance of orders due to economic reasons, down 83 percent YoY at $900 million, compared to $5.3 billion at the same time last year. The projection for Q4 is likely to be about the same as Q3, with current trends very likely to persist. Total plant and other large construction projects will continue to roll in during Q4, too, with orders projected at $16.5 billion. Orders for the full year are expected to reach $40 billion as large construction firms have been working on landing big deals including a coal-fired power plant in Kazakhstan worth $2.5 billion, the Quria multiple thermal power plant in Saudi Arabia worth $1 billion and the Ruwais Refinery Expansion Project worth $8 billion in the United Arab Emirates, among others.

In the meantime, the MKE set up a special team to take charge of plant projects inside the Machinery Aviation System Division in acceptance of pleas from the construction industry. Their tasks would include government support for overseas project orders and enhancement of Korea¡¯s competitive edge in winning heavy plant construction projects overseas through expanded R&D activities and training talented human resources, among others. The new team is expected to strengthen government support to the construction industry for winning plant construction project orders overseas by enhancing its competitive edge and thus contributing to clinching other such orders. nw

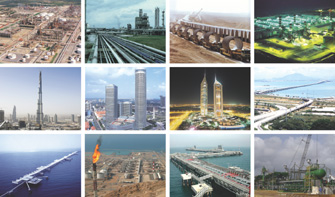

Korea¡¯s track record of construction made overseas: (top row, from far left) SK E&C¡¯s Cadereyta refinery expansion project in Mexico,; Daewoo E&C¡¯s project for the Nigerian National Petroleum Corp.; Dong-Ah Construction Industrial¡¯s grand waterway project in Libya with the world¡¯s s highest single project price; Doosan Heavy Industries and Construction¡¯s Fujairah power and desalination plant in UAE,; (central row, from far left) Samsung C&T¡¯s ongoing Burj Dubai, world¡¯s highest skyscraper,; Ssangyong E&C¡¯s Rapples City Complex,; Ssangyong¡¯s Emirates Towers Dubai Hotel,; Hyundai Engineering & Construction¡¯s (HDEC) Penang Bridge.; (below row, from far left) HDEC¡¯s Jubail port in Saudi Arabia, HDEC¡¯s South Pars project in Iran,; HDEC¡¯s new oil pier and associated topside facilities at MAA refinery in Kuwait,; and Hyundai Heavy Industries¡¯ Forgados crude oil storage facility in Nigeria.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799