Rosy Outlook for Korean Economy

2009 growth forecast in positive territory and more than 5% next year

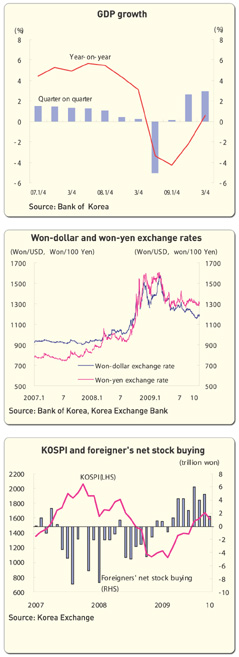

Optimistic prospects over the Korean economy prevail overwhelmingly. Even the government indicates signs of a shift from its rather conservative position, as the Korean economy is predicted to expand into positive territory for this year, recovering from the global economic downturn, with even the 2010 outlook of higher than 5 percent in some cases.

Some financial sources raise the possibility of raising interest rates while sounding worries that inflation pressure will heat up.

In the latest forecast on the growth of the Korean economy, the Organization for Economic Cooperation and Development (OECD) said on Nov. 19 it has readjusted upward Korea¡¯s 2009 growth projection to 0.1 percent, up 2.3 percentage points from its June outlook of a 2.2 percent contraction.

Foreign investment banks have followed suit in making positive growth forecasts for Korea. Deutsche Bank revised upward to 0.4 percent from a 1.2 percent contraction. Barclays said Korea is predicted to grow 6.4 percent in the fourth quarter of this year over the same period of 2008 and 6.4 percent in the first quarter of next year. HSBC put Korea¡¯s 2009 growth projection in positive territory, based on a high growth projection in the fourth quarter due to a recovery of consumption in the private sector.

Strategy and Finance Minister Yoon Jeung-hyun said in a meeting with heads of major state-financed and private economic research institutes on Nov. 20 that the economy could grow next year more than the government¡¯s early growth estimate of 4 percent.

The Korea Development Institute (KDI) revised upward its earlier 2010 economic growth projection of 4.2 percent to 5.5 percent. KDI also readjusted upward its 2009 economic outlook from a 0.7 percent contraction to 0.2 percent growth. Private research institutes, making economic growth projections on a quarterly basis, are expected to release 2010 economic growth outlook versions indicating more than the government¡¯s initial projection of 4 percent.

Deutsche Bank suggested the highest growth rate of 5.5 percent for next year among foreign investment banks. While Barclays, Morgan Stanley and Nomura each predicted 5 percent growth.

Revision projections by foreign investment banks are likely to go beyond their earlier average growth estimate of 4.2 percent.

Controversy could flare up over the timing of raising interest rates as the national economy is growing at a faster pace.

BNP Paribas said it could not rule out the possibility of an interest rate hike, but most foreign investment banks see the timing of an interest rate increase occurring next January. JP Morgan, HSBC and Goldman Sachs expected the Bank of Korea to indicate an interest rate hike possibility in December before the actual increase next January. Morgan Stanley and Nomura predicted that the central bank will raise the basic rate within next January.

Many foreign investment banks forecast that the magnitude of the rate hike could be greater due to the delay of the rate increase. Goldman Sachs predicts the magnitude of the hike at 0.75 percentage points, while Morgan Stanley and Nomura sees the hike range at 1.5 percentage points.

The Monetary Policy Committee of the Bank of Korea decided on Nov. 11 to maintain the basic rate at its current level of 2.00 percent for the intermeeting period.

The committee said domestic economic activity has shown a recovering trend thanks to the progress of the global economic situation. Exports, domestic demand and production have improved further. There still remains, however, uncertainty as to the economic growth path, it said.

According to the central bank, consumer price inflation has remained stable, influenced by the appreciation of the Korean won against the U.S. dollar. The upward trend of real estate prices appears to have faltered.

In the financial markets, the volatility of price variables such as stock prices and interest rates has expanded somewhat while the growth of mortgage lending has continued to flatten out due to the expansion of the areas where debt-to-income ratios are applied and lending rates are higher.

The central bank said in its financial stability report overview released on Nov. 19 that thanks to the eased credit risk aversion in the financial markets, market interest rates have been stable, share prices have rebounded and the Korean won exchange rate is on the decline to remain stable against major currencies. In order to firmly maintain financial system stability, it said, it is important to closely examine potential risk factors and take appropriate actions.

The OECD report also noted that as the Korean economy recovers, the government should scale back spending growth in order to ensure a balanced budget in the mid-term fiscal management plan. nw

The Korean economy is forecast to expand into positive territory for this year and grow more than 5 percent next year.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799