Korean Economy Recovering from Crisis Faster Than Other OECD Nations

IMF to deal with such topics as quota reform

Minister Yoon Jeung-hyun of the Ministry of Strategy and Finance (MOSF) will lead a Korean delegation to the 2009 Annual Meetings of the Board of Governors of the World Bank Group and the International Monetary Fund, to be held from Oct. 6-7 in Istanbul, Turkey. The following are excerpts of a NewsWorld interview with the MOSF Minister, who touched on topics regarding the upcoming IMF/WB meetings and the Korean economy, among other things.

Minister Yoon Jeung-hyun of the Ministry of Strategy and Finance (MOSF) will lead a Korean delegation to the 2009 Annual Meetings of the Board of Governors of the World Bank Group and the International Monetary Fund, to be held from Oct. 6-7 in Istanbul, Turkey. The following are excerpts of a NewsWorld interview with the MOSF Minister, who touched on topics regarding the upcoming IMF/WB meetings and the Korean economy, among other things.

Question: Please tell us about the topics to be discussed during the 2009 Annual Meetings of the Board of Governors of the International Monetary Fund and World Bank Group (IMF/WB).

Answer: The 2009 IMF/WB Annual Meetings will likely take up the reforming of the IMF quotas as a major topic. The IMF has swiftly responded to the recent global financial crisis by taking such steps as boosting its lending resources by $500 billion and dramatically relaxing lending terms in order to help the global economy escape from the worst situation.

However, it is the utmost task of the IMF to raise the newly emerging countries¡¯ representation by readjusting their quotas to better correspond to their expanded economic power in order to help the IMF not only continuously perform the financial institution¡¯s role as a safety net of the global economy, but also to serve as a major forum designed to discuss the future course of the global economy.

Q: Will you elaborate on international cooperation designed to resolve the global financial crisis, which the upcoming annual meetings will deal with?

A: The IMF/WB annual meetings are expected to discuss how to promote international cooperation on the establishment and implementation of an exit plan. It is very essential to make prior preparations and ensure international cooperation for the establishment of an exit strategy so as to alleviate uncertainties of the markets and prevent a double-dip recession that could be caused by the retracting of stimulus policies. This principle was agreed at the Group of 20 (G-20) Finance Ministers¡¯ Meeting held in London in early September. The upcoming annual meetings are likely to be an occasion to spread consensus on the agreement among all 186-member countries.

The IMF is also expected to step up surveillance activities against financial institutions in the post-financial crisis world. Many countries demand the stepping up of surveillance against major countries considered to have a great impact on the global economic systems, and proposals are likely to be made.

Q: What about the recovery of the global economy and forecasts?

A: The global economy appears to be improving from the economic downturn faster than predicted due to each country¡¯s stimulus steps, efforts to stabilize financial markets and international cooperation.

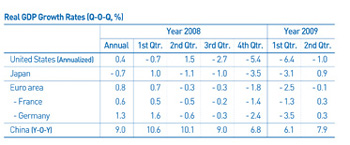

Such major countries as the United States and euro member countries saw second quarter GDP growth rates improve by large margins over the previous quarter. Japan, Germany and France saw GDP growth rates revert to positive growth rates for the first time in five quarters. This gives high hopes of the global economy turning around.

Entering the second half, the global economy is forecast to keep on improving as the international financial markets remain stable and each country¡¯s stimulus steps continue to take effect.

Major organizations, including the Organization for Economic Cooperation and Development (OECD), have tended to revise their growth forecasts upward. However, the continuing of a sluggish employment environment is expected to slow down the pace of recovery, and such risks as misgivings over crude oil price hikes and the exacerbating of losses of financial institutions still exist.

Q: Will you speak about the status of Korea¡¯s fast economic recovery and the forecast for an exit plan?

A: The Korean economy appears to be recovering from the downturn faster than other OECD member countries thanks to the effects of the government¡¯s steps to respond to the economic crisis.

Korea is almost the only country among major countries across the world to post a 0.1 percent growth rate in the first quarter of this year over the previous quarter and a 2.6 percent growth rate in the second quarter, higher than originally forecast.

Stock prices have surged and the Korean exchange rate against the dollar has dropped on expectations of economic recovery and the relaxation of market uncertainties. The Korea Stock Price Index (Kospi) plunged from 1,448 in late September 2008 to 1,076 in late December before rising to 1,162 in late February 2009 and 1,206 in late May and 1,395 in late August. The Korean won exchange rate surged from 1,188 won in late Sept. 2008 to 1,258 won in late December and 1,516 won in late February 2009, but nosedived to 1,273 won in late May and 1,245 won in late August.

Consumer and investor sentiment indexes have maintained signs of improvement, riding on expectations of economic recovery. The Consumer Sentiment Index rose from 84 in March 2009 to 98 in April, 106 in June, 109 in July and 114 in August, while the Business Sentiment Index (BSI) climbed from 50 in March 2009 to 60 in April, 76 in June, 78 in July and 93 in September.

Given a lack of the private sector¡¯s own economic recovery power and external and internal economic uncertainties, currently, the time is not ripe for discussing the execution of an exit plan.

The G-20 Finance Ministers¡¯ Meeting held in early September shared the view that the global economy should maintain expansionary macroeconomic policies until it enter a full recovery phase. But the participants concurred on the need for making prior preparations for the timely execution of an exit plan after comprehensively examining the economy, prices and asset market situations.

Q: Will you explain the status of the government¡¯s plan to advance public enterprises to the levels of advanced countries and its future plans?

A: Take a look at the status of options of advancing public enterprises to the levels of advanced countries. Of 24 public entities subject to the privatization process, one public entity was disposed of, there are six that are ready to be auctioned off and the rest are undergoing a prior preparatory process. The sale of Korea Asset Investment Trust Co. and Korea Real Estate Investment Trust Co. is on public notice, while preferred bidders have been chosen to buy Ansan Urban Development Inc. and Farmland Improvement & Modernization Co.

Of the 36 candidate public enterprises subject to merger or consolidation, 28, including Korail Tech and Korea Creative Content Agency, have been consolidated into 12 entities, while a process for merging eight public entities into four is underway.

Of the five candidates for elimination, four public enterprises, including Korea Labor Education Institute and Korea Ad.com, were abolished while the disbanding of the fifth one is underway.

The government is seeking to revise related laws to put two public enterprises into market competition.

Of the 20 candidate entities to have their functions adjusted, nine have completed the process, one will be subject to function readjustment in 2009 and 10 others will be affected between 2010 and 2012.

Of the 129 entities to have their employee numbers cut, 125 have had their manpower reduced by 22,000 employees or 12.7 percent of manpower out of 175,000, and four others are also eliminating staff.

Thirty-five public enterprises subject to disposal, elimination, liquidation and merger & consolidation have 131 subsidiaries, 27 of which have been disposed of.

The ministry plans to complete the plan for advancing public enterprises without a hitch by taking stock of the implementation process of the plan as announced. nw

Minister Yoon Jeung-hyun of the Ministry of Strategy and Finance (MOSF)

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799