Jump-start for Emerging Industries

New Growth Engines 2009 to publicize new growth vision and development strategies

The following are excerpts of an interview between NewsWorld and Huh Kyung, director-general for Emerging Industries at the Ministry of Knowledge Economy, in which he elaborated on government policies to nurture new growth engine industries to drive the national economy in the years to come.

The following are excerpts of an interview between NewsWorld and Huh Kyung, director-general for Emerging Industries at the Ministry of Knowledge Economy, in which he elaborated on government policies to nurture new growth engine industries to drive the national economy in the years to come.

Question: Will you tell our readers about the background of hosting New Growth Engines 2009 and the benefits the exhibition will bring?

Answer: The nation needs to explore and nurture new national growth engines in order to overcome the current economic crisis and ramp up national competitiveness for the future. In this vein, this past January the government established the new growth engine vision and development strategy in which it confirmed 17 new growth engines on which the future of Korea will hinge.

New Growth Engines 2009 will be held from May 26-28 to help the general public and companies get a better understanding of new growth engines and build a social consensus toward them. The MKE and 13 other government agencies have teamed up to organize the fair, which will coincide with such diverse events as an international conference and an investment explanation session.

The purpose of the exhibition is to present to the public and private sectors ways to promote national competitiveness through new growth engines and build the momentum to implement them by raising the awareness of new growth engines to the public and companies. The exhibition is expected to build a consensus on the need to embrace policies on new growth engines by unveiling them as the breadwinners of the future to the public and raise social awareness toward them. In particular, the introduction of the government's diverse support steps is expected to lure corporate investments in the new growth engine sectors.

Q: Will you sum up New Growth Engines 2009?

A: New Growth Engines 2009, which will open for a three-day run on May 26 at KINTEX, will coincide with diverse events including an opening ceremony, an exhibition, an international conference and an investment explanation session.

Tom Peters, a globally renowned consultant, will give a keynote speech and SK Group Chairman Chey Tae-won will speak about "New Growth Engines, Korea's Hope Projects" during the opening ceremony.

Josef S. Meilinger, representative of Siemens Korea, will lecture about strategies to implement new growth engines and Perry Ha, CEO of DFJ Athena, will deliver a lecture titled "New Growth Engines: South Korea and Silicon Valley" at the international conference.

Approximately 160 companies and research institutes will participate in the exhibition designed to publicize technologies and products in 17 new growth engine arenas.

The government's core policies on the support of new growth engine industries will be announced at the investment explanation session to spur private sector investments. They will include policies on the New Growth Engine Smart Project, the operation of the New Growth Engine Fund, the provision of support to SMEs and the exemption of tax inspections to related companies and manpower development on new growth engines.

Q: Will you introduce the New Growth Engines 2009 exhibition?

A: The fair, to be jointly hosted by 11 government agencies, will be composed of 17 new growth engine pavilions in three zones, a green growth experience pavilion and three special pavilions. Spectators to the 17 new growth engine pavilions will be given an opportunity to experience first hand what new growth engines would be like in the future. They will provide to the private sector a channel to lure investments.

The green growth experience pavilion will be a place for spectators to see the top 10 green growth projects first hand. The three special pavilions will be designed to publicize three topics: jobs, consultations on funds and SMEs.

The participating exhibitors will include KEPCO, KT, Hyundai Motor Co., Samsung SDI, Samsung SDS, POSCO E&C, LG CNS, Hyundai Rotem, LS Industrial Systems, LG Life Science, Samchully and Chong Kun Dang Pharm.

Q: Will you explain the international conference, a side event of New Growth Engines 2009?

A: Korean and foreign cases of securing growth potential through the cultivation of new growth engines from the global perspective as well as implementation strategies will be disclosed and panel discussions on the direction of development will be held at the international conference. About 500 people from industry, academia and research circles are expected to participate in the international conference, which will consist of five sessions and three panel discussions. Domestic and foreign cases, corporate new growth strategies and investment values in three growth engine arenas will be announced at the five sessions to serve as a good opportunity to take a look into the need for nurturing new growth engines through Korean and foreign investments.

Prof. Toshio Hirota, of Waseda University in Japan; Roland Villinger, CEO of McKinsey & Company Seoul Office; Cho Suk, deputy assistant of the MKE; and Kim Ju-hyung, president of the LG Economic Research Institute, will exchange views on the direction and vision of emerging industries.

Q: Will you introduce the investment explanation session of New Growth Engines 2009?

A: The session will proceed with the presentation of each government agency's policies on emerging industries, the future direction of technology development and human development, which will be followed by question and answer sessions. In particular, government policies on the New Growth Engine Smart Project and the operation of a new growth engine fund are expected to become the subject of attention as steps to lure investments from the private sector.

Q: Will you tell us about the status of convergence industries, their prospects and development strategies?

A: The general trend of industrial developments is that industries now have the tendency to evolve through convergence. There are quite a few cases of managing to survive through divergence, but a multitude of success stories are coming out of convergence extending to not only high technology, but also to conventional industries, services and art.

Some large-sized companies and some venture firms manage to rely on convergence to secure a competitive edge, while most SMEs tend to fail to do so without knowing what the megatrends are.

Whether we can make another economic leap forward hinges on what way or how fast convergence is forecasted to proceed and whether or not we can jump start the market. The government strives to have synergetic effects of simultaneously implementing short- and long-term convergence policies together with a new growth engine vision and a development strategy, while helping SMEs build infrastructure for convergence and providing support to SMEs so that collaboration with large-scale companies can be attained. The government plans to come up with diverse support steps to invigorate industrial convergence. Exchanges of diverse information and views among experts from different fields will be promoted through industrial convergence forums to explore suggestions to ensure value-added convergence. Institutional systems and regulations will be revamped or eliminated, while convergence teams will be operated together for the expansion of convergence technology.

Q: Will you elaborate on the status of the bio and nano industries, their prospects and development strategies?

A: Capitalizing on the production of products and services via biotechnology, the bio industry is vigorously involved in so-called "Red-Bio" in the pharmaceutical field and "White-Bio" in the bio-chemical field. The development of each new medicine takes an average of 12 years and costs an average of approximately 700 billion won, but the yearly added value of each medicine is the equivalent of exporting 3 million units. The biochemistry industry, producing bio-materials and products, is emerging as a green technology as bio-materials and processes have replaced the existing petrochemical materials and processes.

The global bio industry, estimated at $124 billion in 2008, posted an annual average growth rate of 11.1 percent. The Korean bio market, which fetched about $3.9 billion or 3.1 percent of the global market in 2008, grew an average of 19.7 percent between 2006 and 2008. Korea's technological levels have reached 60 to 70 percent of those of advanced countries. Making the most of the achievements and capabilities the nation has accumulated so far, the government seeks tangible outcomes within the next five to 10 years and the laying of an industrial foundation for the biochemistry and food fields.

Korea aims at evolving into a global top seven life science powerhouse by 2015.

The strategic technology development project and "Bio-Star Project," which have set aside 25.6 billion won and 12.8 billion in 2009 respectively, are parts of efforts to spur the development of original technologies and commercialization-stage technologies.

The nano-convergence industry, emerging as a new-breed "cash cow" field, is evolving into diverse types of convergence industries considered to be essential for the continuing of national economic growth. The global nano-convergence industry is projected to grow to $2.95 trillion in 2015 according to a 2008 report from Cientifica, the world's largest nanotechnology information and consultancy company. Nanotechnology applications are projected to be used on 4 percent of general products, half of electronic and IT products and 16 percent of life science items by 2014, and could create about 10 million jobs, Lux Research estimated in 2004. The Korean nano-convergence market is forecast to post an annual growth rate of a remarkable 22.6 percent by 2020, KISTEP said in 2005.

Korea places fourth among the ranking of nanotechnology powerhouses following the United States, Japan and Germany. Korea has a wide technology gap with advanced countries with its technological levels reaching 66 percent and 73 percent compared to the United States and Japan/Germany, but it is not easy for Korea to retain its number four position due to intensive investments by the governments of latecomers Russia and China.

The nation has set its sights on making Korea a global top three nano-convergence powerhouse by 2015. It aims at seizing a 15 percent share of the global nano-convergence industry or $230 billion, nurturing 500 nanotechnology companies and 10 mid-size core companies and creating more than 30 world's -best original nano-convergence technologies and innovative products.

To nurture the nano-convergence industry, the government has designated five fields, including the energy/environment and biomedical sectors, in addition to the existing mainstay fields of electronics, materials and process/equipment.

Q: Will you give details on the status of the Korean software industry, its prospects and development strategies?

A: The global software market grew from $727.6 billion in 2004 to $915.2 billion in 2007 with an annual average growth rate of 7.9 percent, according to figures made available from the IDC in 2008 and from the ETRI in 2007. The market is projected to grow to $1.14 trillion in 2011 with an annual average growth rate of 5.8 percent between 2008 and 2011. An acceleration of convergence among industries has caused the portion of software development unit prices in each manufacturing field and the size of the embedded software industry to rise. Figures on the Korean software market released in 2007 showed that the embedded software field accounted for a 51 percent share or $8.9 billion, followed by the IT service sector with 34 percent or $6 billion and the packaged software field with a 15 percent share or $2.6 billion. The government has taken such steps as quality-based business process improvement, the cultivating of software expertise manpower, the exploring of software-based service models and the supporting of overseas market entry.

A software process quality certification system will be stepped up to upgrade software engineering processes and the establishment of a software engineering center will be considered by this coming August.

The government will put in place an educational system in which software companies and universities collaborate in developing joint educational programs, cultivating excellent students and hiring graduates, and another program in which end-user client software companies and employees themselves are involved in the design and operation of educational programs.

The government plans to support the exploration of such software-based service models as Saas (Software as a Service) as well as raise the added value of manufacturing industries by combining software and existing manufacturing industries.

It plans to support the exploration of the overseas packaged software market and the simultaneous entry into the foreign market by small-, mid- and large-sized companies by making core solutions of IT services modules.

Q: Will you comment on the status of the domestic design industry, its prospects and development strategies?

A: The design industry is a representative, low-cost, high-efficiency, knowledge-intensive value-added industry, thus greatly contributing to the development of manufacturing, service and other industries. Figures released by the government in 2006 showed that the design industry topped the list of value-added rates with 42.9 percent, followed by the semiconductor industry with 31.6 percent, the textile industry with 21 percent and the automobile industry with 17 percent. World-class corporations are scrambling to secure a competitive edge in design. Korea placed ninth among the rankings of design powerhouses in 2007 thanks to the government's active steps to promote the design industry, combined with a rising corporate concern in design and investments. The size of the global design industry registered an explosive growth rate of 68 percent over the recent five months to surge from 4.1 trillion won in 2001 to 6.8 trillion won in 2006.

The government plans to help spread design innovation, now focused on such specific areas as handsets, home appliances and automobiles, to other industries.

Q: Will you speak about the status of the robot industry, its prospects and development strategies?

A: Robots emerge as a representative end-user item of the 21st century in the era of post-automobile and post-PC, considered to be a core growth engine of the future that will take the lead in raising the per-capital national income to $40,000.

A convergence industry with far-flung technological spillover effects, the robot industry is expected to set up a new convergence infrastructure to revolutionize all industries in the post-IT era. The size of the global robot industry is projected to surge from $8.1 billion in 2007 to $30 billion in 2013 and $100 billion in 2018. The Korean market, ranked fifth in the world with a market value estimated at 895.7 billion won in 2008, saw signs of continuous growth with a growth rate of 18.8 percent over 2007.

The government has ambitious robot development strategies tailored to three different periods with the goal of making Korea a global top three powerhouse by 2013 and the leader by 2018. It will focus on technology commercialization pilot projects during the current market expanding period; joint purchase of common infrastructure technologies, to be developed in the mid- and long-term during the new market creation period by 2012; and securing original robot technologies in the long-term during the technology leadership period by 2018.

According to the development roadmap, Korea will likely see the size of the Korean robot industry rising to 4 trillion won, its global market share soaring to 13.3 percent, exports surging to $1 billion and related new jobs rising to 13,800 people by 2013. nw

The emblem of New Growth Engines 2009 being held under the catchphrase "Jump-start Korea."

Huh Kyung, director-general for Emerging Industries at the Ministry of Knowledge Economy

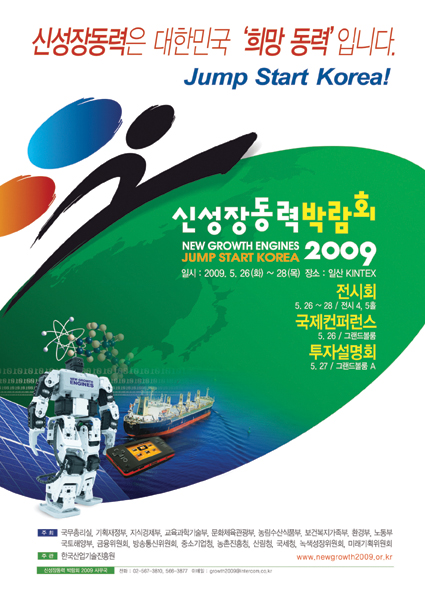

The poster for New Growth Engines 2009, being held at KINTEX in Goyang, north of Seoul from May 26-28.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799