Int'l Cooperation to Cope with Economic Crisis

Fully supports ADB financial roadmap

Minister of Strategy and Finance Yoon Jeung-hyun will lead a Korean delegation to the 42nd Annual Meeting of the Board of Governors of the Asian Development Bank, to be held from May 5-6 in Nusa Dua, Bali, Indonesia. The following are excerpts of a NewsWorld interview with the minister of the Ministry of Strategy and Finance (MOSF), who touched on the topics of the upcoming ADB meeting and the Korean government's plan to advance public enterprises.

Minister of Strategy and Finance Yoon Jeung-hyun will lead a Korean delegation to the 42nd Annual Meeting of the Board of Governors of the Asian Development Bank, to be held from May 5-6 in Nusa Dua, Bali, Indonesia. The following are excerpts of a NewsWorld interview with the minister of the Ministry of Strategy and Finance (MOSF), who touched on the topics of the upcoming ADB meeting and the Korean government's plan to advance public enterprises.

Question: First, please tell us about the topics to be discussed during the 42nd ADB annual meeting and the planned activities of the Korean delegation.

Answer: The 42nd ADB annual assembly will focus on the ADB's role in coping with the global financial crisis. In particular, just ahead of the annual session, the ADB has approved a bill for general capital increase by 200 percent from the current one. As such, the institute will likely play an expanded role in helping regional countries suffering financial difficulties.

In addition, the ADB will discuss a variety of support measures such as a system for the promotion of liquidity of member countries and expansion of mutual loans.

The Korean government plans to dispatch finance minister as the chief delegate who will, through a key-note speech and meeting with ADB head, Haruhiko Kuroda, underline the need for close cooperation among member countries in bids to address the global financial crisis while expressing support for the increase in ADB capital. He will also emphasize the Korean government's efforts to cope with the economic crisis as a chairman nation of the G-20 including sharing experience with the process of clearing bad loans.

Ahead of the ADB meeting, he will take part in the finance ministers' meeting between Korea, China and Japan as well as the ASEAN plus three forum, to review the economic situation of the region and discuss ways to strengthen regional cooperation in the face of the financial crisis, including the Chiang Mai Initiative (CMI) and the Asian Bond Market Initiative (ABMI).

Q: Can you touch on the government stance in calling for more regulations to help cope with the lingering global financial crisis?

A: Governments around the world are discussing means for speeding up the implementation of financial regulations to tackle and prevent a recurrence of the financial crisis as debated at the recently-ended G-20 meeting of world leaders.

1. Appropriate regulations will be introduced for the hitherto uncontrollable financial commodities run by hedge fund and credit rating companies, to prevent the recurrence of the financial crisis.

2. Economic cycle-related measures will be adopted through, for instance, accumulating shock-absorbing capital and improving regulations regarding allowances for uncollectable assets and a market price assessment system.

3. We plan to improve the compensation system for financial institutions so that they can more strictly carry out risk management.

4. We will also revise the accounting system to raise the transparency in the trading of complex financial commodities and off-balance sheet transactions while standardizing over-the-count derivatives trading.

By carrying out these and other financial regulatory measures, we will be able to help stabilize the international financial system while removing the regulatory difference between nations and providing a stage for fair competition.

In the meantime, we believe there is a growing need to consider specific situations faced by respective nations in implementing such regulatory measures.

Q: What are the processes and outlook with regard to the currency swap?

A: The Korean government has managed to efficiently cope with the destabilizing factors in the financial market through an expansion of currency swap contracts with the United States, China and Japan. For instance, we signed a currency swap deal worth $30 billion with the U.S. on Oct. 30 last year and expanded the swap lines with China and Japan to the $30 billion level last December, each.

Ushering in this year, we also extended by six months the swap maturity with the U.S. and Japan until Oct. 30.

But it is not proper to comment on the outlook of future swap deals especially with the U.S., as it is a contract between nations and has huge economic consequences.

Q: What about the key economic policies for the year 2009?

A: While putting first priority on overcoming the current economic crisis, the Korean government has been making strenuous efforts to improve the economic fundamentals to prepare for the post-crisis period.

1. We are speeding up efforts to stabilize the macro economy by adopting expansionary fiscal stimulus measures in order to prevent the economy from losing resilience due to a prolonged economic slump.

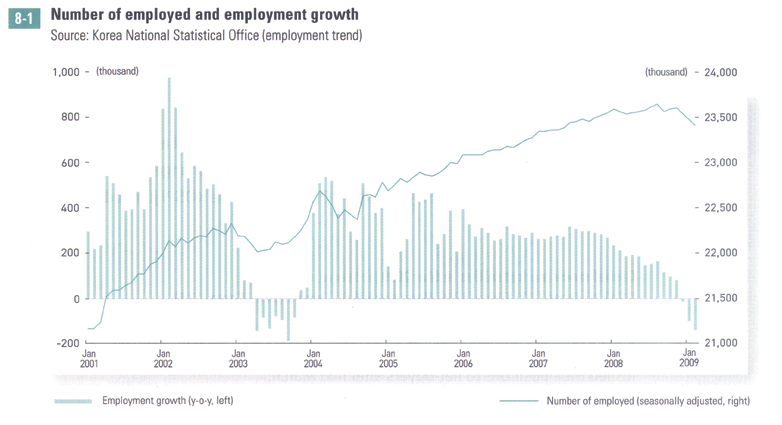

-We are maximizing the role of the government treasury through extra budget to stimulate domestic consumption and stabilize the employment market.

-Such efforts are in line with the global endeavors of the G-20 industrial and emerging nations.

2. We will also seek to maintain social integrity for sustained growth by expanding assistance to the less privileged class now facing difficulties due to the economic crisis.

3. Considering the real economy will not recover unless the financial institutions operate normally, we will take steps to ease the credit crunch by supplying liquidity and expanding credit guarantees while easing market uncertainty through steady corporate restructuring.

4. Additionally, we will prepare steps for the post-crisis period including the green industry, service industry advancement, deregulation and promotion of R&D investment and human resources.

Q: Can you tell us about the project regarding the advancement of public enterprises?

A: The purpose of advancing state-run enterprises is to revamp the function of public organizations and promote the efficient use of manpower and resources, thus helping ease people's burdens and raise the national competitiveness.

Toward that end, the government has been carrying out a series of measures designed to advance the state-run companies through privatization, merger & shutdown, functional realignment, managerial efficiency and restructuring of subsidiaries on six occasions from August last year.

Unless we make efforts toward reform, we may face a bigger crisis. So the advancement of public firms is a must in the face of the economic hardship.

We will closely check the process of the advancing project to link the results to the assessments of the managerial performances of relevant chief authorities as part of efforts to ensure managerial efficiency in terms of function, organization and human resources of state-run organizations. nw

Minister of Strategy and Finance Yoon Jeung-hyun

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799