Construction Industry Looks Overseas to Overcome Crisis

On the domestic front, the industry faces immediate restructuring

The global economic downturn has been roiling national economies, including Korea's, threatening to have side effects on all sectors including construction. The Korean construction industry, reeling from the effects of heaps of unsold apartments and a plunge of real estate prices, are endeavoring to find an exit to the emergency situation: turning to the overseas construction industry to overcome the current crisis.

The local construction industry is faced with immediate restructuring, so Korean contractors' struggles to keep them afloat is enormous, industry analysts concur. However, Korean construction companies paint a rosy picture of the overseas construction industry, which has shown signs of being a bright spot despite a little dent from the effects of the global economic slowdown.

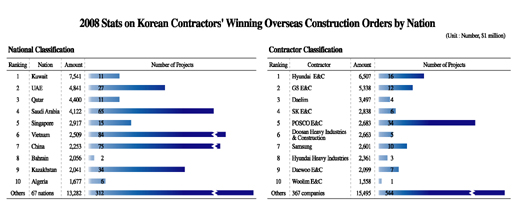

In fact, 2008 was a stellar year for the Korean construction industry, which landed a record high of $47.6 billion worth of construction orders from abroad thanks to an on-and-off hike of crude oil prices and the development boom in the Middle East.

The global pain has begun to be felt in Korea's overseas construction industry, but the scope of the adverse effects would not be much, according to industry analysts.

Despite the global economic crisis, Korea is now predicted to post more than $40 billion worth of construction orders from abroad during 2009.

Meanwhile, the Korean government has been implementing mega-projects including the Gyeongin Canal and the restoration of the nation's four main rivers ¡ª the Han in Seoul, the Geum in the Chungcheong and North Jeolla regions, the Yeongsan in South Jeolla Province and the Nakdong in the Gyeongsang region ¡ª in a desperate effort to shore up the sagging national economy. In this regard, it has been front-loading 2009 government budgetary outlays in the implementation of public projects in the first half.

The Gyeongin Canal, which will link the Han River and the West Sea, will have a wide range of spill-over effects in such areas as transportation, tourism and leisure industries. In keeping with the Seoul Metropolitan Government's so-called Renaissance Plan to renovate the Han River, ferries will run on a direct route linking Yongsan, central Seoul, and China, while yachts and boats will be able to navigate along the planned route connecting the Han River and the West Sea via the Gyeongin Canal. Areas surrounding Songdo, Cheongna and Geomdan will be developed as western landmarks of the Seoul metropolitan area.

TRACK RECORD OF KOREA'S OVERSEAS CONSTRUCTION INDUSTRY

Here is a look into the success story of Korea's overseas construction industry, which made its debut in 1965. Korea celebrated the $200 billion mark in the aggregate value of winning construction orders in February 2006, and it took less than three years for Korea to surpass the accumulative $300 billion. Hyundai Engineering & Construction's winning of a $330 million office building project from Singapore last Dec. 26 brought to more than $300 billion the accumulated value of orders Korean contractors have landed from abroad so far.

OVER $300 BILLION IN ACCUMULATIVE VALUE OF ORDERS

The industry suffered a setback sometime in the wake of the 1997 Asian financial crisis. But since 2004, when it entered a renewed boom period, the industry chalked up an annual record high of $47.6 billion worth of orders in 2008, above the goal of $40 billion.

As of Dec. 31, 2008, 731 Korean contractors chalked up an accumulative $300.1 billion in 6,635 projects from 118 countries. Out of the total, 447 contractors are now carrying out $118.5 billion worth, covering 1,250 projects in 87 countries.

The industry has seen the value of orders won reaching more or less $5 billion per annum since the 1997 Asian financial crisis before making a leap forward in 2004 when it posted $7.5 billion in orders won. It further picked up speed in landing orders thanks to a domestic and global business boom.

The overseas construction industry has served as a buttress to back up the national economy due to its dynamic nature. It has contributed to being a force behind the country's economic growth since it is a source for earning foreign currency without resulting in imports.

By area, the Middle East region took a 58 percent share, or $174.6 billion, to become the biggest overseas market for Korean contractors. Next came the Asian market with Singapore and China leading with a 31 percent share, or $94.2 billion.

Korea won $16.5 billion in orders from Africa and Central and South America, regions in which the value of achievements is now smaller compared to other regions, but it shows signs of rising if the government's and industry's joint efforts to diversify pay off.

By country, Saudi Arabia, Libya, Kuwait and Singapore topped the list of nations awarding orders.

By engineering classification, the plant sector, one of the Korean industry's mainstays, accounted for $124.3 billion, or 41 percent of the accumulative value. The civil engineering and architecture areas, which served as its mainstays in the 70s and 80s, each chalked up $74 billion and $88.8 billion, respectively. Before and after 2000, the industry suffered difficulties due to challenges from latecomer China with its price competitive edge, but Korea began to pick up speed in landing orders from such high-sophistication areas as high-rises, ports, tunnels and bridges in 2007. nw

Korea's track record of construction made overseas: (top row, from far left) SK E&C's Cadereyta refinery expansion project in Mexico,; Daewoo E&C's project for the Nigerian National Petroleum Corp.; Dong-Ah Construction Industrial's grand waterway project in Libya with the world's s highest single project price; Doosan Heavy Industries and Construction's Fujairah power and desalination plant in UAE,; (central row, from far left) Samsung C &T's ongoing Burj Dubai, world's highest skyscraper,; Ssangyong E&C's Rapples City Complex,; Ssangyong's Emirates Towers Dubai Hotel,; Hyundai Engineering & Construction's (HDEC) Penang Bridge.; (below row, from far left) HDEC's Jubail port in Saudi Arabia, HDEC's South Pars project in Iran,; HDEC's new oil pier and associated topside facilities at MAA refinery in Kuwait,; and Hyundai Heavy Industries' Forgados crude oil storage facility in Nigeria.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799