Concern Growing Over

Global Economic Debacle

At least 2-3 years needed for stabilization

Concerns are growing over the rapidly spreading global financial crisis to the extent of fears that the entire global economy will crumble for at least the foreseeable future.

Concerns are growing over the rapidly spreading global financial crisis to the extent of fears that the entire global economy will crumble for at least the foreseeable future.

What matters is the fact that the current crisis, which was triggered by the subprime mortgage debacle in the United States, shows no sign of easing. Some experts even forecast the crisis will last for at least three to five years.

It seems financial crises follow a similar path, which is how South Korea's 1997 currency crisis unfolded and the latest financial turmoil has developed.

Crises usually start with the inflating of bubbles. Before the 1997 crisis, there were many bubbles in the Korean economy due to decades of high growth rates, often nearly 10 percent annually. Chaebol, or the large business conglomerates, financed their growth by borrowing rather than by issuing stocks or bonds, resulting in many of them being highly leveraged. They built vast factories on loans and then faced a domestic slowdown and growing competition from imports in accordance with lowered trade barriers.

These corporate bankruptcies left the financial health of banks and other financial firms in doubt. Merchant banks, in particular, raised foreign-currency funds massively abroad to lend to the chaebol and other local companies, and had to buy dollars to cover their foreign-debt obligations -- one of the key reasons behind the country's currency crisis 11 years ago. All these were the results of bubbles.

The recent global financial crisis also originates from the U.S. housing bubble. Alan Greenspan's recurring interest rate cuts to prop up the sagging economy in the early 2000s after the tech bubble burst prompted Americans to rush to buy homes with little financial burden, thus inflating the bubble. A property bubble lurks in South Korea due to the real estate price hikes through the end of 2006. Another bubble, arising from people's fund fever last year, looms large.

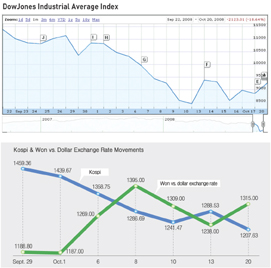

Speculation shows up when the economy exhibits vulnerabilities amid ever-inflating bubbles. In late 1997, when Korea was teetering on the brink of bankruptcy, wild speculators preyed on the won in the over-the-counter non-deliverable forward (NDF) market in Singapore, bringing down the Korean currency to nearly 2,000 won to the greenback. In the latest currency turmoil that peaked last week, currency speculators launched attacks for short-term gains. In a sense, these speculative actions might be a natural capitalistic phenomenon. What is clear is that the government should always arm itself with the power and instruments to thwart these attacks by speculators.

Fear comes with speculation, as everyone watches market indicators warily. In 1997 and 1998, Korea's stocks and currency took a nosedive in a turbulent sea of corporate bankruptcies, bad debt and tight credit. Interest rates jumped at the request of the International Monetary Fund that orchestrated a $55 billion package to rescue the world's then 11th-largest economy, driving companies into a credit squeeze. Job losses fell on employees of banks, previously one of the safest occupations. At the height of the crisis, national bankruptcy looked unavoidable.

Last week, fear gripped the nation again, prompting many people to talk about another crisis, this time initiated by the United States, the world's largest economy and Korea's strongest ally, amid plunging stocks and the won's steep devaluation. The fear came as a shock because South Koreans still have painful memories of the currency crisis in the late 1990s. The very thought that they may have to undergo difficult times again was dreadful enough to set off alarms for them.

In 1997, South Korea suffered an unprecedented crisis. This year, the turmoil has yet to develop into a full-blown crisis. At the time, the IMF was there to help South Korea, but the international organization might not serve as a savior this time since the United States and most Western countries are struggling to deal with their own problems.

There is a lot of a difference in the economic fundamentals of then and now. South Korea's foreign exchange reserves reached nearly $240 billion recently and most of it can be used immediately. But in late 1997, when the crisis reached a climax, reserves stood at less than $20 billion with usable reserves falling to as low as $8.9 billion. The financial soundness of companies and banks has improved a lot as well. The corporate debt-to-equity ratio, which had surged above 400 percent, has also fallen to less than 100 percent. Banks also maintain their non-performing loans at minimum levels.

While fears about the global market meltdown eased this week, it's too early to expect the latest financial turmoil to be brought under control. Rather, the world may have entered the long tunnel of recession just now, casting a dark cloud over the early recovery of a Korean economy that relies heavily on exports.

But the real threat may have not come yet as the Korean version of a subprime mortgage crisis could occur amid falling property prices. The amount of loans banks and other financial firms lent by collateralizing housing units has reached 300 trillion won and household income remains in the doldrums in the midst of an economic downturn. Against this backdrop, interest rates have soared in the aftermath of the global credit crunch, forcing more households to default on loans. In fact, the default rate at savings banks has already surpassed the dangerous level.

It's worrisome enough to see economic policymakers failing to win the people's confidence at a time when the role of government is increasing. In times of crisis, preemptive measures should be taken with no hesitation. The crisis can turn into a blessing in disguise depending on how it is dealt with.

Despite all the measures taken by the global society and individual governments, it remains to be seen whether such steps will have any effect in the long run. The Korean government has been eager to resolve the matter through a package of measures. But what is most important is how the administration will win the support of the people and the confidence of the market through consistent and efficient policies. nw

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799