Economic Crisis Looms Large

Calls grow for shift of economic paradigm

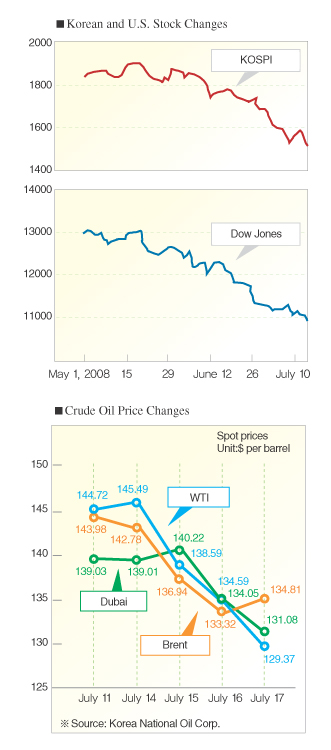

The global financial markets are severely fluctuating, affected by the rise and fall of international crude oil prices. The economic factors are even more complicated due to the lingering impact from the U.S. subprime mortgage crisis on the global market. The anxiety over the credit crisis in the U.S. financial markets was rekindled by the crippling of the two U.S. mortgage giants -- Fannie Mae and Freddie Mac. The near collapse has rippled through the Korean economy and caused a shudder in the local financial market.

The global financial markets are severely fluctuating, affected by the rise and fall of international crude oil prices. The economic factors are even more complicated due to the lingering impact from the U.S. subprime mortgage crisis on the global market. The anxiety over the credit crisis in the U.S. financial markets was rekindled by the crippling of the two U.S. mortgage giants -- Fannie Mae and Freddie Mac. The near collapse has rippled through the Korean economy and caused a shudder in the local financial market.

The KOSPI index plunged to a yearly low of 1,489.86 during intraday trading on July 16, down 19.47 points from the previous close, though it rebounded the following day, boosted by a steep fall in international crude oil prices and an overnight rise in the U.S. stock market.

With the financial market's dive coinciding with high inflation and an economic slowdown, there are growing concerns that Korea may be experiencing a credit crisis triggered by a deadly cocktail of asset deflation and rising interest rates.

Market experts say that if the U.S. credit crisis continues, it will exacerbate domestic woes, dealing a fatal blow to the faltering economy and financial market.

They warn that the world's 13th largest economy has become increasingly vulnerable to a credit crisis as a result of banks'aggressive expansion through reckless lending in the midst of rising stagflationary pressure.

"Excessive loan growth is weakening the base of the Korean economy. Rapid loan growth has forced Korean banks into the capital market for funding, which became a source of vulnerability when the credit crisis erupted in 2007 and remains the Achilles heel of the economy today,"an official said. He noted that loans are growing by nearly 16 percent year-on-year, more than twice as fast as nominal GDP growth. Loan growth accelerated to 15.2 percent in May from 15.1 percent in April.

In particular, loans to households and small and medium enterprises (SMEs) are more exposed to default risks. Despite the economic downturn, banks'loans to smaller firms stood at 398.9 trillion won in May, up 28.9 trillion won from December. The overdue rate on such loans increased to 1.3 percent in March from 1 percent in December.

What is most worrisome is household debt -- the individual debt ratio has risen sharply, with household debt outgrowing income. The pace of growth of Korea's household debt has been even faster than that of the United States. Such debts in Korea grew by 210 percent between 2001 and 2006, compared with 190 percent in the U.S.

In particular, mortgages at banks are feared to emerge as the main trigger of another credit crisis. It is highly probable that many of them will go bad once the value of the assets, such as real estate and stocks, decline amid an upward spiral of interest rates.

"Korean mortgages remain dangerous financing instruments because they are short-term loans without amortizing payments to pay down the principal amount on a gradual basis,"Seoul Financial Forum Vice Chairman James Rooney said.

"So I call them 'time bombs'that can explode if credit market conditions become tighter when borrowers need to refinance,"he added. "That creates unnecessary financial and economic risk to Korean borrowers and the Korean economy."According to Real Estate 114, a real estate services provider, prices of apartments in Seoul fell 0.04 percent for the first week of July, continuing a losing streak for the third straight week.

Stock prices also took a heavy beating, with the KOSPI closing at a yearly low of 1,507.40 on July 16, down about 25 percent from the yearly high of 1,888.88 on May 16.

On the other hand, interest rates on mortgages have jumped by more than 0.25 percentage points since April. Home mortgages reached 229 trillion won in June, up 35.5 percent from 169 trillion won at the end of 2004.

"I think that current debt levels and overdue rates are within a controllable range, and it is too early to say that the economy is entering a phase of asset deflation,"a ranking Bank of Korea official told The Korea Times, asking not to be named.

"However, if asset values drop by an additional 20 to 30 percent, chances are that the country will face another credit crisis,"he added.

The government is particularly worried over a deadly combination of rising overdue rates and asset deflation caused by falls in real estate and stock prices, believing that a sharp fall in asset values may result in massive defaults on loans secured by those assets.

Andy Xie, an independent economist and former Morgan Stanley chief economist overseeing the Korean economy, said that Korea has become vulnerable to a massive property bubble as a result of growing stagflationary pressure.

"Korea may be experiencing a massive a property bubble funded by debt. A decline of asset values and a rise of the consumer price index (CPI) are a deadly combination,"he said.

Alarmed at rising credit risks associated with bank loans, the Financial Supervisory Service (FSS), the nation's financial watchdog said Tuesday that it will step up its monitoring of bank loans to prevent lenders from enlarging assets recklessly.

It pointed out that local banks'competition to increase assets without proper risk management is likely to pose a threat to their soundness.

Spiking oil prices and higher inflationary pressure have forced the Lee Myung-bak administration to lower its 2008 economic growth target to 4.7 percent from its earlier figure of 6 percent. The downward revision came somewhat late, considering that the downside risks have already become conspicuous. Lee's economic team is under criticism for being too slow to recognize all the gloomy indicators and change its policy to meet mounting challenges at home and abroad.

Despite the growing seriousness, no one is trying to hold Lee responsible for his failure to make good on his "747"campaign pledge to raise the annual growth rate of the economy to 7 percent, hike per capita national income to $40,000 and transform the country into the world's seventh-largest economy. Of course, more than a few people are disappointed with Lee's unrealistic economic pledges. Right after his inauguration, the government set the growth target at 6 percent, down 1 percentage point from Lee's promise.

Lee and his policymakers have enough excuses to avoid any blame for sharply trimming the growth projection, although they have to admit that the President painted too rosy a picture during the election campaign last year. The excuses include the skyrocketing prices of crude oil, other natural resources and grains. Skepticism is growing that the nation can even achieve the revised growth target of 4.7 percent this year because of rapidly deteriorating economic indicators.

To the dismay of people aspiring for an economic revival, the Organization for Economic Cooperation and Development (OECD) slashed its growth outlook for South Korea to 4.3 percent last month from an earlier 5.2 percent. The International Monetary Fund (IMF) also cut its projection from 4.2 percent to 4.1 percent. The two international institutions could make an additional cut as the world economy is also faced with higher downward risks.

The Bank of Korea (BOK) earlier predicted the economy would grow 4.6 percent this year, down from last year's 5 percent. It forecast consumer prices would surge by 4.8 percent, escalating concerns about stagflation. According to the central bank, the nation will suffer from a current account deficit of $9 billion. The projections are based on an assumption that the average oil price will stand at $115 per barrel throughout the year.

What matters is that oil prices have already surpassed $140 per barrel. South Korea, one of the world's top oil-consuming countries, is taking the brunt of higher inflationary pressure. The BOK acknowledged the economic slowdown might be accelerated as a result of soaring inflation. nw

ˇáKorean and U.S. Stock Changes

ˇáCrude Oil Price Changes

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799