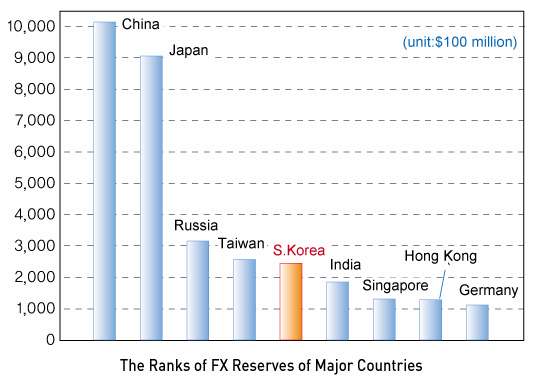

FX Reserves Keep Rising

Korea's exchange reserves 5th largest in the world at $243.9 billion

Korea's foreign exchange reserves totaled $243.92 billion as of March 31 this year, up $1.1 billion from December 31, last year, the Bank of Korea said on April 2.

Korea's foreign exchange reserves totaled $243.92 billion as of March 31 this year, up $1.1 billion from December 31, last year, the Bank of Korea said on April 2.

The figure breaks down to $202.68 in securities (83.1 percent), deposits $407 billion (16.7 percent), IMF position $4 billion (0.2 percent), SDR $600 million and gold bullion (0.03 percent). Korea is the 5th largest country in terms of foreign exchange reserves in the world after China ($1.066 trillion), Japan ($905 billion), Russia ($311.1 billion), and Taiwan ($268 billion).

Korea's economic growth this year is likely to reach 4.4 percent, lower than 5 percent last year with the second half growth greater than the first half spurred by exports, the Bank of Korea said in a report on 2007 GDP projection.

The central bank said the first-half growth is likely to hit around 4 percent, while that for the second half is likely to hit 4.7 percent.

The report said private consumption in the first half of this year would be around 3.7 percent much lower than 4.4 percent during the same period last year. It will escalate to 4.2 percent in the second half for 4 percent for the whole year.

Private consumption is expected to slow to 4 percent lower than 4.2 percent last year due to slowdown in the number of persons employed, the heavy household debt burden and fiscal spending are likely to offset the improvement in terms of trade resulting from international oil price stabilization.

The government consumption is projected to increase 4.5 percent, lower than 5.3 percent last year. Investments in construction would dip 1.2 percent in the first half, but rebound to 1.8 percent in the second half to record 1.6 percent for the whole year.

Facility investment is projected to increase 6 percent, 5.9 percent in the first half and 6.2 percent in the second half.

Exports are likely to rise 10.8 percent this year and imports of goods 11.1 percent, the central bank said. Facility investment will continue to show improvement centering on machinery investment, boosted by continued pressure for investment and the favorable movements of leading indicators.

Exports are likely to rise 10.8 percent this year and imports of goods 11.1 percent, the central bank said. Facility investment will continue to show improvement centering on machinery investment, boosted by continued pressure for investment and the favorable movements of leading indicators.

Construction investment is anticipated to show a weak recovery since the sluggishness of the housing construction market will offset the launch of the BTL projects and the implementation of balanced national development projects.

On a year-to-year basis, construction investment is likely to remain sluggish until the first half of this year and shift to an increase in the second half(2.2 percent year-on-year in the second half of 2006, to -1 percent slide in the 1H of this year and to 1.8 percent increase in the H2.

Commodity exports are forecast to maintain growth of 10.8 percent for this year down from 12.9 percent last year with 3.7 percent growth in the H1 and 3.1 percent jump in the H2 bolstered by the recovery of the IT industry and the quality competitiveness of core products, although the growth rate is expected to decline from last year in line with a global economic slowdown.

The governor, in a special interview to mark his 1st anniversary in office, recalled that the central bank's monetary policies took aim at toughening financial relaxation measures in tandem with the growth level of the economy little by little. He said since he took control of the central bank, the central bank readjusted the benchmark interest rate twice, raised the deposit reserve rate once, and revised the overall loan limit once. He said the moves were properly taken by the central bank in light of the economic movements and the financial market from government policies.

He said the BOK has adopted the look-at-everything management policies, meaning that the monetary policies will consider various factors including economic growth, consumer prices, the financial market and asset market, among others to make them more comprehensive and boosted the reserve rates for foreign currency and currency deposits.

Last year, the central bank raised the benchmark call interest rate twice, one in June and the other in August by 0.5 percentage points each time. The moves were intended to ease side effects from the low interest rates on the economy. nw

Bank of Korea Gov. Lee Seong-tae.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799