KRX Strives to Be Premier Financial

Market in Northeast Asia

Pursues the vision of becoming a global exchange

With a consolidation in 2005, the Korea Exchange, Inc. (KRX) has been pursuing the vision of becoming a global exchange. In an effort to enhance its competitive edge, there are several business plans that KRX is currently promoting.

With a consolidation in 2005, the Korea Exchange, Inc. (KRX) has been pursuing the vision of becoming a global exchange. In an effort to enhance its competitive edge, there are several business plans that KRX is currently promoting.

First, KRX is seeking to cross-border trade with overseas counterparts and list foreign shares on its market at the same time.

Starting with the talks with Singapore Exchange (SGX) and Chicago Mercantile Exchange (CME), KRX is seeking for the possibility of a cross-border trading. Last November, KRX signed the memorandum of understanding with CME to foster exchange of information for a possible futures market cross-border trading and agreed to engage in a research with KRX on such.

The discussion with SGX on cross-border trading is expected to start shortly after completing the preliminary market research. With the results obtained from the market research, once the discussion dates are set for both organizations, the push forward on cross-border trading is expected.

Mr.

Lee Young-tak, the chairman and CEO of KRX mentioned that "if the cross-border trading becomes successful, it will offer diverse investment opportunity for domestic investors in addition, it will likely increase the demand of Korean securities abroad. By eliminating restrictions amongst countries, the user-convenience will be enhanced and it will give a competitive edge to an exchange."Another focus area since the consolidation is listing foreign shares on KRX. Presently, the Korean government is promoting the transformation of Korea into the financial hub in Northeast Asia. Listing foreign shares not only fulfill the Korean government's wish and it is expected to hasten the globalization of Korean bourse.

Lee Young-tak, the chairman and CEO of KRX mentioned that "if the cross-border trading becomes successful, it will offer diverse investment opportunity for domestic investors in addition, it will likely increase the demand of Korean securities abroad. By eliminating restrictions amongst countries, the user-convenience will be enhanced and it will give a competitive edge to an exchange."Another focus area since the consolidation is listing foreign shares on KRX. Presently, the Korean government is promoting the transformation of Korea into the financial hub in Northeast Asia. Listing foreign shares not only fulfill the Korean government's wish and it is expected to hasten the globalization of Korean bourse.

As a part of promoting listing foreign shares on KRX, KRX Chairman Lee attended listing promotion seminar in China and paid visits to few companies.

As long as the problems associated with the Chinese firms'non-tradable shares are resolved, there will be some outcomes to be achieved by the end of this year according to the source familiar with the matter say.

Meanwhile, in preparation for taking initiatives for global market leadership amid fierce competition among exchanges and establishment of the consolidated capital market Act, KRX continues to develop and introduce advanced products.

KRX 100 Stock Index futures composed of indexes derived from both stock and KOSDAQ markets will be launched sometime this year. Energy futures for the purpose of hedging in the midst of hiking oil prices are also being considered. Currency futures such as Japanese Yen futures and Euro futures will be introduced during the first half-year 2006.

So far, the Korean futures market has been focusing on the financial products however, lately it shifted its attention to developing new livestock futures product such as lean hog.

Similar to the phenomenon that KOSPI 200 futures and options once transformed the previously unknown Korean derivatives market into the spotlight of the world, when the Korean government completes the ongoing consolidation of capital market regulations, it is expected to enhance the Korean derivatives market once more.

Intensifying competition is taking place among exchanges throughout the world and Asia is not an exception. Hostile mergers and competition have been practiced for a long time in an exchange industry and NASDAQ's recent attempt in acquiring London Stock Exchange (LSE) and the announcement of the chairman of TSE of a possible merger with an American exchange once again proves that.

KRX Chairman Lee recently attended the Asian Oceanian Stock Exchanges Federation (AOSEF) in Taiwan mentioned that the main interest of member exchanges were the movement towards the consolidation and merger between exchanges.

In ready for such competition, KRX is taking necessary steps such as preparing for its IPO, cross-border trading, foreign listing on Korean market and improvement of new products and hopefully these will serve as a catalyst to hasten the realization of KRX to become a premier capital market in Northeast Asia. nw

Lee Young-tak, the chairman and CEO of KRX

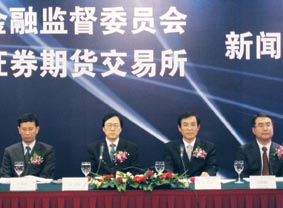

KRX Chairman Lee and other officials attend a news conference designed to explain KRX's plan to list Chinese companies into the Korean bourses on March 8, 2006, in China.

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799