Sovereign's Real Intention is Still Shrouded in Mystery

- SK vs. Sovereign case presages a warning against Korean blue-chips' management

Sovereign Asset Management's recent call for convening an extraordinary shareholding meeting of SK Corp. portends a preview of the second round of the SK management versus Sovereign showdown next March.

Last month, Sovereign fired a salvo to run the gauntlet against the management of SK Corp., the holding company of SK Group, as the former demanded an extraordinary session aimed at discussing the qualification of directors sitting on the board of directors, a move interpreted as attempting to target SK Group owner Chey Tae-won. As SK Corp. turned down the offer, the Sovereign side took the case to the court as the latter filed a lawsuit requesting the permission for convening the extraordinary session. A few days later, a court rejected it.

The Sovereign side has taken a low profile since it suffered a setback in its face-off with SK Corp. management during last March's shareholders' general meeting despite its strenuous efforts to muster support from minority shareholders, particularly foreign investors. But the Sovereign side's latest move is construed as a prelude of the second round of fighting; the Sovereign side will stage this during nexts year's shareholders' general meeting. The latest development, coming about seven months since Sovereign's defeat to SK Management last March, has not only renewed a myriad of speculation on what ulterior motive the foreign fund has in reality, but also has sounded an alarming bell against Korean blue-chip corporations whose shareholdings are dominated by foreign investors.

What is Sovereign's real intention, then? Is it a hostile M&A attempting to wrest managerial rights or taking -profits?

The brawl over the management of SK Corp. came to a head when Sovereign purchased a 14.99 percent interest in the nation's largest oil refinery through its subsidiary Crest Securities Ltd. SK Corp. share prices stood at 9,300 won per share at the time of Sovereign's massive purchase, but its latest demand for convening at an extraordinary shareholders' meeting has recently pushed through the record-high 60,000 won level, indicating a whopping five-fold share price hike. It means that Sovereign gets rich-quick by reaping more than 1 trillion won in unrealized profits through the massive purchase of the SK Corp. stock.

Sovereign has since repeatedly demanded for the transparency of management by having disputed SK Corp.'s decisions, including bailing out SK Group's affiliates, SK Networks, formerly known as SK Global and SK Shipping. SK Global was implicated in an accounting scandal. Sovereign, now the single-biggest shareholder, has called for the removal of those convicted of committing illegal practices.

Take a look into the attitude that Sovereign has taken during last March's shareholders' general meeting. Experts familiar with hostile M&As do not rule out that it is possibly a hostile M&A attempt to seize managerial rights of the oil refinery. Sovereign is forecasted to pick up a vote showdown in the coming shareholders' general meeting over the reelection of SK Group owner Chey, due to expiration in early 2005, as it died last March.

Things are unlikely to turn favorable for Sovereign at this time, however. The Sovereign side's cause of improved corporate governance would no longer win over the hearts of many minority shareholders, experts predict. In particular, the People's Solidarity for Participatory Democracy, which has so far favorably responded to the Sovereign side's move, is now increasingly turning negative. Prof. Jang Ha-sung, of Korea University, once reacted favorably, saying that Sovereign had finished up in less than one year the work that the Korean government could not do in several years, but the professor's attitude is apparently cold-shouldering the foreign fund, saying that it lacks justification this time.

What's more, the SK Corp. management side is determined to take a "get-tough policy" saying that it is putting up strong opposition against Sovereign's attempt to re-submit an issue, already rejected during the last shareholders' general meeting, calling it an act of disrupting normal activities with next year's shareholders' general meeting, not far from now. SK Corp. officials said SK Corp. has taken management renovation measures, including overhauling corporate governance, but Sovereign's brazen attack from behind will no longer be tolerated, they said.

What's representing a striking difference between the past and now is the rising support of "white knights" that have come to the aid of SK Corp. management. Large corporations may consider they are in the same boat, according to industrial analysts. Samsung Electronics Co. bought an additional 26 billion won and 65.8 won worth of SK shares last Dec. 8 and Dec. 9, respectively, raising its shareholding in the oil refinery to 1.8 million shares or a 1.39 percent interest.

Samsung has poured 117.4 billion won, accounting for 2.56 percent of its equity value in the benevolent action, even though the company officially denies the role of a white knight of SK Corp. management, saying that its massive purchase of SK Corp. amounts to a form of managing idle money. Earlier last Dec. 2, Pantech & Curitel, the nation's third-largest mobile handset maker, agreed to purchase 459,418 SK Corp. shares, a 0.36 percent interest in the oil refinery.

On the other hand, foreign investors have been net sellers of SK Corp. their combined ownership dropped to 58.74 percent from the all-time high of 61.85 percent, but the Monaco-based investment firm made it public that it will maintain its stake in the oil refinery, 14.9 percent, saying that a lack of commitment to governance touched off foreign investors to dump their SK Corp. shares.

A case in point situation is Korea Line Corporation, which recently overcame a hostile M&A attempt by the Norwegian shipping company, Golar LNG, thanks to support from friendly white knights; POSCO came to the aid of Korea Line Corp. by buying 210,000 shares worth 7.9 billion won or a 2.17 percent interest in Korea Line Corp. in a bid to stabilize the transportation of its raw materials, while DSME followed suit by purchasing a 7.56% stake in DSME or 755,870 shares worth 25.7 billion won.

Hyundai Merchant Marine is in a similar situation as Golar LNG and other Northern European companies have a combined shareholding of over 15 percent in the Korean shipping company. Capital Group, an American asset management company has emerged as the second largest shareholder of Hyundai Motor Co. by acquiring a 14.61 percent stake in Korea's giant automaker. Foreign investors of Samsung Electronics have gone to great lengths to demand such things as the rights to recommend outside directors and moving headquarters to the United States.

Korea's industrial capital is vulnerable to foreign capital

The SK Corp. management versus Sovereign case demonstrates how vulnerable Korean blue-chip corporations like Samsung Electronics can be the target of hostile M&A attempts, particularly from foreign investors.

A stream of foreign capital has been credited with helping the nation recover from the 1997-1998 financial crises. But the problem is that domestic large-scale companies could fall prey to hostile M&A attempts from foreign investors because the domestic financial market is opened at such too rapid pace under the framework of the IMF, it virtually removes Korean companies' tools for defending management rights. Even though most OECD countries have liberalized the entry and exit of foreign capital, they have imposed diverse restrictions on foreign capital's hostile M&A attempts, depending on industrial types and other forms. In the United States where the so-called Poison Pills clause has been introduced, foreign capital's hostile M&A attempts have almost disappeared.

In the past seven years following the Asian financial crisis, foreign investors have gobbled up shares of large-scale corporations. As a result, foreigners' shareholding has shot up from 13.7 percent to 61 percent in SK Corp. stock; from 21 percent to 69.1 percent in POSCO; from 24 percent to 55 percent in Hyundai Motor Co., and from 24 percent to 58.2 percent in Samsung Electronics.

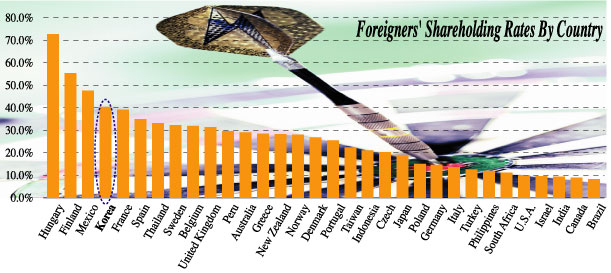

Korea ranked fourth with 43.2 percents in terms of foreigners' shareholding rates as of the end of last September, following Hungary (72.6 percent), Finland (55.7 percent) and Mexico (46.4 percent). The Korean figure is higher than the United States (10.3 percent), Germany (15.0 percent), Japan (17.7 percent) and Taiwan (23.1 percent).

Korean companies' only means of protecting themselves from hostile M&A attempts from foreign investors are the purchase of stock stakes and securing friendly shareholders. Many Korean companies have a record-high cash reserve rate. The reserve rate for the top 10 Korean corporations has surged to 493.9 percent in the third quarter of this year, up 88.5 percentage points from 505.4 percent at the end of last year.

In a statement issued on Dec. 10, the Federation of Korean Industries (FKI) demanded that the government allow pensions and other funds to invest in stocks and cast voting rights in a bid to protect Korean companies from hostile M&A attempts. The statement said the revision of the Fair Trade Law, approved by the plenary session of the National Assembly removed the remaining tool designed to protect hostile M&A attempts.

In a few cases of victims that fall prey to hostile M&A hunters seeking merciless profiteering have been reported. Speculation has arisen that Hermes engaged in share price manipulation to raise its profits from the sale of Samsung Corp. shares. Hermes, the third largest shareholder of the Korean company, said on Dec. 1 that it would support a hostile M&A seeker unless it improves its corporate governance. The U.K.-based fund disposed of its 5 percent stake in Samsung Corp. just one week after allegedly "blackmailing" the latter, and raked in 30 billion won profits stemming from a 43 percent surge in preferred shares.

BIH Fund, a U.K.-based investment company, has conducted paid-in reduction capital on three occasions after acquiring Bridge Securities Co. in 2001, and recouped 159.6 billion won, 72.5 percent of 220 billion BIH invested in the Korean securities company in a short period of time.

A few cases of foreign investors demanding exorbitant dividends have been reported. Pama Fund, the Australian largest shareholder of Meritz Securities Co, raked in 5 billion won in dividends, 15 times as much as 300 million the securities company posted in net income. nw

3Fl, 292-47, Shindang 6-dong, Chung-gu, Seoul, Korea 100-456

Tel : 82-2-2235-6114 / Fax : 82-2-2235-0799